Our most recent survey asked whether our readers are planning to comparison shop during the Medicare open enrollment period for 2022 coverage. We were pleased to see that almost 79% of our respondents said yes — up from about 71% last year.

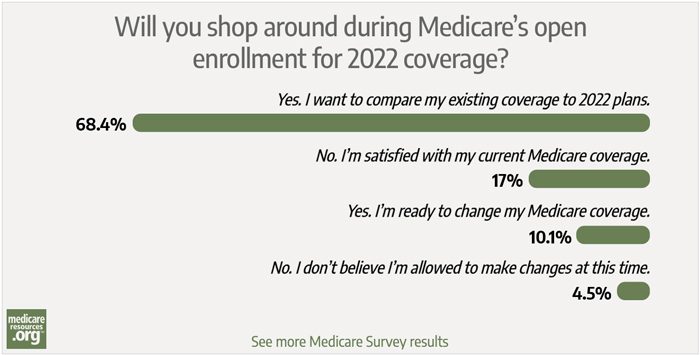

Here’s how the responses stacked up this year:

- 68.4% – Yes, I want to compare my existing coverage to 2022 plans.

- 10.1% – Yes, I’m ready to change my Medicare coverage.

- 17% – No, I’m satisfied with my current Medicare coverage.

- 4.5% – No, I don’t believe I’m allowed to make changes at this time.

The Medicare open enrollment period – also known as the annual election period (AEP) is your chance to make sure that you’ve optimized your coverage for the coming year, and to ensure that you’re not leaving money on the table. During this enrollment period coverage change options include:

- Switching from Original Medicare to Medicare Advantage (as long as you’re enrolled in both Medicare Part A and Part B, and you live in the Medicare Advantage plan’s service area)

- Switching from Medicare Advantage to Original Medicare (plus a Medicare Part D plan, and possibly a Medigap plan).

- Switching from one Medicare Advantage plan to another.

- Switching from one Medicare Part D prescription drug plan to another.

- Enrolling in a Medicare Part D plan if you didn’t enroll when you were first eligible for Medicare (a late enrollment penalty might apply).

Why might more enrollees be comparing Medicare plans for 2022?

Medicare has been in the news quite a bit this fall, with a dramatic increase in the number of plans receiving 5-star ratings for 2022, additional supplemental benefits on some Medicare Advantage plans, and the ongoing discussion in Congress about whether dental, hearing, and vision benefits should be added to traditional Medicare (the latest version of the Build Back Better Act would provide a hearing benefit, but not dental or vision).

Most Medicare beneficiaries usually do not comparison shop during open enrollment, so it’s heartening to see so many of our readers planning to do so this year. The fact that you’re reading our site probably means that you’re interested in learning more about Medicare plans and understanding the options available to you, which helps to explain why our readers are so much more likely to comparison shop than Medicare beneficiaries overall.

Rest assured that the time you spend comparing your options for 2022 will be time well spent. You may end up deciding to switch plans to get a better value or better coverage, or you may decide that your current plan is still the best option – but it will be an educated decision and you’ll know that you haven’t missed a better opportunity.

Who’s not ‘shopping around’ during the annual election period?

More than 21% of our respondents have no plans to comparison shop for Medicare coverage during the current open enrollment period. The majority of those folks said that they’re satisfied with their coverage and thus don’t feel the need to shop around, but some respondents indicated that they don’t believe they’re allowed to make a plan change at this point.

To clarify, the current open enrollment period doesn’t apply if you have an employer-sponsored or retiree plan that supplements your Medicare coverage. And it also doesn’t allow you guaranteed-issue access to a new Medigap plan.

But you may find that you do still have options during open enrollment, including the ability to switch between Medicare Advantage and Original Medicare, or to enroll in Medicare Part D prescription drug coverage for the first time. Before you give up on open enrollment, be sure to check with a broker or the Medicare State Health Insurance Assistance Program (SHIP) in your state. (If you’d like to talk to a licensed agent about your coverage options, you can call the number at the top of this page.)

Four reasons to comparison shop for 2022 Medicare coverage

If you need a reason to comparison shop this fall – even if you’re 100% happy with your current coverage – here are a few:

- There are fewer Part D plans available for 2022, and consolidation has resulted in some national plans leaving the market. If you’re enrolled in a plan that’s ending and you don’t pick your own new plan, you’ll be automatically re-enrolled in a replacement plan – but it might not be the one you would have chosen for yourself.

- Even if your plan will continue to be available, the provider network or covered drug list might be changing. Or your own medical or prescription needs might be changing. Or there might be new plans available in your area that would provide a better value.

- Average star ratings for Medicare plans have increased for 2022. There might be some highly ranked plans in your area that you haven’t noticed before.

- Average Medicare Advantage premiums are decreasing for 2022, and more plans are offering innovative supplemental benefits for people with various chronic illnesses. There’s also an increase in the number of Part D plans (including Medicare Advantage plans with integrated Part D coverage) participating in the Senior Savings Model, which limits out-of-pocket costs for certain insulins.

Three tips for comparing coverage during Medicare open enrollment

If we’ve convinced you to comparison shop during open enrollment, there are several things to keep in mind:

- Shop first based on major criteria, like total expenses (premiums plus out-of-pocket costs), how a plan will cover your prescription drugs, and whether your preferred doctors and hospitals are in-network. Then you can further narrow your options by using factors like star ratings and extra benefits (gym memberships, dental and vision, etc.).

- When you’re checking to see how your prescriptions would be covered under the various Part D options, be sure to check multiple pharmacies – you might find that you’re able to save money by switching to a different local pharmacy or using mail order.

- Medicare Advantage continues to grow in popularity and CMS expects 29.5 million people to be enrolled in Advantage plans for 2022. But if you’re switching to Medicare Advantage, be sure you understand how Medigap enrollment works if you later decide that you’d rather switch back to Original Medicare (and would want a Medigap plan to supplement it). Here’s more about deciding between Medicare Advantage and Medigap.

Open enrollment has already been underway for two weeks, so you may have already done your shopping for 2022. If not, you have until December 7 to check the available options and determine what will best fit your needs and budget for next year.

The plan you select during open enrollment will take effect on January 1. And if you’re enrolled in Medicare Advantage for 2022, you’ll have another chance to make a plan change in the first quarter of next year, during the Medicare Advantage Open Enrollment Period.

Louise Norris is an individual health insurance broker who has been writing about health insurance and health reform since 2006. She has written dozens of opinions and educational pieces about the Affordable Care Act for healthinsurance.org. Her state health marketplace updates are regularly cited by media who cover health reform and by other health insurance experts.