EDITOR’S NOTE: Our Medicare Surveys “take the pulse” of our audience – assessing our readers’ experiences with Medicare and their attitudes toward the program. The questions and the results are not intended to be scientific.

Our latest reader survey was all about how Medicare costs match up to expectations. We asked Medicare beneficiaries if – now that they’re Medicare enrollees – their healthcare costs have been higher than they expected. The vast majority of our respondents (184 participants) said Yes.

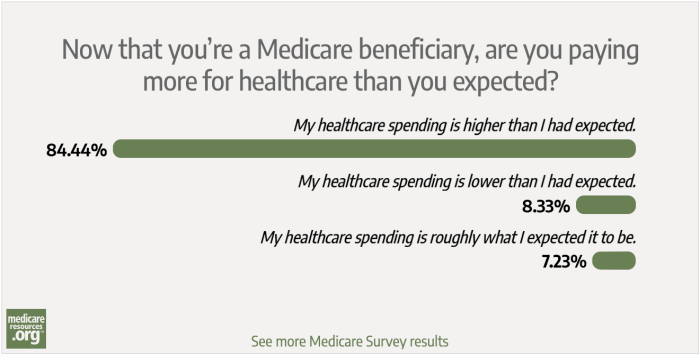

Here’s how our readers answered:

- 84.44% said their healthcare spending is higher than they had expected

- 8.33% said their healthcare spending is lower than they had expected

- 7.23% said their healthcare spending is roughly what they expected it to be

In addition to the survey answers, we got some detailed replies on Facebook, which included various perspectives. Several people noted that their premiums and out-of-pocket costs are lower with Medicare than they were with their pre-Medicare health plans. But others lamented the high cost of Medigap plans, the lack of dental coverage, the 20% coinsurance for Medicare Part B, and the unaffordable out-of-pocket costs for prescription drugs. One respondent noted that she had to cancel her cataract surgery because the out-of-pocket cost wouldn’t fit in their budget.

Although there are certainly some Medicare beneficiaries whose healthcare spending has not been more than they expected, that’s not the case for most people who responded to our survey. So let’s take a look at why that might be, and most importantly, what options you have if you’re facing unaffordable healthcare costs.

Why are costs higher than beneficiaries anticipated?

Higher-than-expected costs for Medicare beneficiaries likely stem from incorrect expectations about Medicare, a lack of annual comparison shopping for coverage, unexpected health problems that result in significant out-of-pocket costs, or some combination of those factors.

In terms of expectations, we often hear from people who weren’t aware that Original Medicare has no cap on out-of-pocket costs, doesn’t cover routine dental and vision care, requires an additional private plan in order to have drug coverage (which also has no cap on out-of-pocket costs), and doesn’t cover custodial long-term care.

And for people who have been on Medicare for a while, unexpectedly high expenses could also result from sticking with the same Part D or Medicare Advantage plan year after year, rather than shopping around during open enrollment each year. The plan that worked best several years ago might no longer be the best option, due to changes in the plan itself or changes in the beneficiary’s medical needs.

Unexpected medical issues can obviously push your healthcare costs higher than you thought they’d be, even if you already had a solid understanding of how Medicare’s coverage and pricing works. But you may find that a plan change during the upcoming enrollment period this fall might help to mitigate your increased costs going forward.

What can Medicare enrollees do to keep their healthcare costs as low as possible?

If you’re facing healthcare costs that are higher than you expected, here are some things to keep in mind:

- Check to see if you’re eligible for full Medicaid coverage in addition to Medicare, or for a Medicare Savings Program. Eligibility varies by state, but is based on both income and assets. (Select your state to see more details.)

- Consider a Medigap plan (also known as a Medicare Supplement) if you’re enrolled in Original Medicare without any other supplemental coverage (from Medicaid or an employer’s plan). The best time to do this is in the first six months after you enroll in Medicare, since the coverage will be guaranteed-issue, regardless of your medical history. But even if that window has passed, you can still apply for coverage and see if you’re offered a plan. Medigap plans will cover some – or nearly all – of the deductibles and coinsurance you’d otherwise have to pay yourself, including the unlimited 20% coinsurance for services covered by Medicare Part B.

- While we’re talking about Medigap, here’s a reminder to consider all the plans – and not just the most popular ones. Medigap plans are standardized, which makes them much easier to compare than other types of coverage. But the most popular choices – Plan F (only available to people who became eligible for Medicare prior to 2020) and Plan G – are the most comprehensive, and therefore tend to be among the most expensive options. Even if you can’t afford the monthly premiums for the Medigap plans that will cover virtually all of your out-of-pocket costs, you may find that one of the other Medigap plans fits in your budget and still protects you from high medical bills. This could be especially true if you’re currently healthy but find yourself dealing with a significant medical issue in the future — any Medigap plan is going to be better than nothing at all in that situation.

- Actively compare the available Part D plans in your area, checking to see how they’d cover your medications, and how much your costs would vary if you used a different pharmacy or switched to a mail-order pharmacy (be sure to check multiple pharmacies, as you may see significant price differences depending on which one you use). For most people, a plan change will need to wait until the fall (October 15 to December 7), for coverage effective next January. And it will be important to compare the available options during that enrollment window, as plan designs and pricing change from one year to the next. But most Medicare beneficiaries don’t switch plans during open enrollment, even if it would save them money to do so. Don’t let inertia keep you stuck in a plan that’s no longer working for you!

- If you need insulin, consider one of the Part D plans that cap the cost of certain insulins at $35/month (Note that even among the Part D plans that participate in this program, there’s wide variation in terms of which insulins qualify for the reduced out-of-pocket costs. Participating plans select from a list of model insulins, but only have to cover at least one pen form and one vial form for each of the types of insulin.) You’ll want to also account for the premium and how the plan will cover any other prescriptions you need.

- If you’re enrolled in a Medicare Advantage plan, actively compare the other available plans during the October 15 – December 7 enrollment window this fall. You’ll want to check with your doctor to make sure they’ll continue to be part of the provider network of any plans you’re considering, as networks can change from one year to the next.

- If you’re enrolled in Original Medicare without a Medigap supplement and have found that you’re now unable to enroll in Medigap due to your medical history (because your initial enrollment window has closed), keep in mind that Medicare Advantage plans do include a cap on annual out-of-pocket costs that currently can’t exceed $7,550 – not counting the cost of drugs. (Part D coverage is integrated with most Medicare Advantage plans, but out-of-pocket costs are not capped, as is the case with stand-alone Part D coverage.)

- If you’re considering a Medicare Advantage plan, check to see what extra benefits are offered and whether they’d provide value to you. Most Medicare Advantage plans include at least some coverage for routine dental and vision care, as well as various additional benefits that aren’t included in Medicare Parts A and B. But Advantage plans tend to have much more limited provider networks than the nationwide access to healthcare providers that Original Medicare offers. Here’s a resource that includes some of the pros and cons of Medicare Advantage.

Louise Norris is an individual health insurance broker who has been writing about health insurance and health reform since 2006. She has written dozens of opinions and educational pieces about the Affordable Care Act for healthinsurance.org. Her state health exchange updates are regularly cited by media who cover health reform and by other health insurance experts.