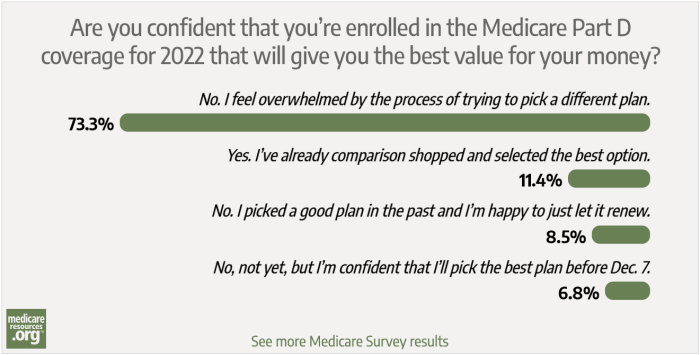

As a Medicare beneficiary, you have a multitude of choices to make. From my experience dealing with frustrated Medicare enrollees, I can tell you that selecting the right prescription drug plan is one of the most important. If you make the right choices, they can save you huge sums of of money and headache, while ensuring you have access to the medications you need.

My family is a perfect example: When I sat down with a great uncle a few years ago to take a look at his Part D coverage, it was very quickly obvious that he was overpaying – about $2,000 too much – for coverage for prescription drugs he needed. Even with my immediate family, my father had the right drugs covered but was paying too much – by hundreds of dollars each year.

My family members are just two examples out of the millions of Americans – more than 54 million as of 2024 – who are enrolled in Part D coverage, including those with stand-alone Part D plans and those with Part D coverage integrated with a Medicare Advantage plan; about 80% of all Medicare beneficiaries have Part D coverage.

Why we needed a Part D benefit

Or call

866-472-0949 (TTY 771) to speak to a licensed insurance agent

(Mon-Fri 8am-9pm, Sat 10am-7pm ET)

Before Medicare included an optional prescription drug benefit, many Medicare members had to choose between paying their electric bills and buying groceries or getting their prescriptions filled. Today, the situation is much improved – especially for seniors who take the time to carefully choose a Part D plan that covers their medications – with potential savings in the thousands of dollars each year for people who are wise shoppers.

Medicare beneficiaries access these prescription drug benefits through private Part D plans – the Medicare drug benefit program created in 2003. Because it is based on competition among individual plans, seniors and people with disabilities have many options. Even better news: simply by being an active shopper every year, you can find the best coverage for your needs while saving thousands of dollars.

And the Inflation Reduction Act has greatly improved Medicare Part D benefits. As of 2025, Medicare Part D enrollees will pay no more than $2,000 in out-of-pocket costs for drugs covered under their Part D plans. And other Inflation Reduction Act improvements have already taken effect in previous years, including $35 insulin, free vaccines, and the elimination of cost-sharing once a person reached the catastrophic coverage level.

When tackling Medicare Part D, here are seven rules of the road.

1. Know your shopping window.

You have from October 15 through December 7 to shop around for a new Part D plan or change your Medicare Advantage coverage for the following year (if you’re enrolled in Medicare Advantage, you have another window, from January 1 to March 31, when you can switch to a different Medicare Advantage plan — including one that has integrated Part D coverage — or switch to Original Medicare and enroll in a stand-alone Part D plan).

Because most people can’t change plans outside of this shopping window, it pays to be prepared. Some Medicare members can safely remain in their current plan without increased costs from one year to the next. In fact, some need to remain for other reasons (such as having their best option for Medicare health plan benefits and doctors tied to their Part D coverage, as explained below).

But for many Medicare beneficiaries and their caregivers, shopping around for new and better options will help them save money and ensure they can continue benefitting from the Medicare program’s promise of affordable and accessible health coverage for Americans who need it most.

During your shopping window each fall, it’s important to keep in mind that changes will take effect starting in January, leaving you the option to change your mind more than once during the fall open enrollment window. And if you’re enrolled in a Medicare Advantage plan, you get another opportunity to change your mind during the Medicare Advantage open enrollment period that runs from January 1 to March 31, although only one plan change is allowed during that January-March window.

Looking for 2024 Medicare coverage with lower premiums? Talk with a licensed advisor now. Call 1-844-309-3504.

2. Check your Medicare Advantage plan.

If you have a Medicare Advantage plan, you usually have to receive your drug benefits through the plan rather than a separate Part D insurer.

If you are one of the growing number of Medicare beneficiaries who receive their hospital and physicians benefits (Medicare Part A and Part B) through a private Medicare Advantage plan, that same insurer probably provides your Part D coverage (89% of all Medicare Advantage plans included integrated Part D coverage in 2024). This means that when you change your Part D plan, your health and hospital benefits change too.

You should consider switching Medicare Advantage plans if your plan’s Part D formulary (covered drug list) for the coming year would limit your ability to continue taking your current prescriptions. Just be sure to choose a replacement Medicare plan that will also cover your current health care providers – in addition to covering your medications. (The same Medicare.gov plan comparison tool is used to compare Medicare Advantage plans — including their prescription benefits — as well as coverage offered by separate Part D plans.)

Unless you’re really comfortable using a computer and other Internet tools, the best way to select a Part D plan is to contact the government’s 1-800-MEDICARE call center and ask the customer service agent to spend some time and walk you through the process of using Medicare.gov’s online Plan Finder to select a new plan.

You can also work with a local health insurance broker who can guide you through the process — the broker you use for other insurance products might work with Medicare plans as well, or will likely be able to refer you to one who does.

3. Check your formularies – and drug costs.

Plans change their lists of covered drugs (formularies) and the drugs’ costs each year. Because prescription drugs are expensive, plans need to change their benefits and can require you to pay more (or less) for the same medication from one year to the next.

Another thing to be aware of is that Part D plans can add requirements that you receive the plan’s approval before covering your current medications next January. This is known as prior authorization or pre-certification.

If you can’t find a plan that covers all your medications, you may be able to work with your doctor to get your existing plan (that has changed your current medication to require pre-approval) to cover the drug anyway. To help speed up the process, you should keep any letters from your Part D insurer if it has approved coverage for one of your medications this year – as evidence to support your case.

If you take multiple medications, you might find that some of your medications are covered by some plans, but none of the plans cover all of your medications. In that case, pay attention to how much each drug would cost without insurance (GoodRx is a useful tool for this), and consider enrolling in the plan that best covers the most expensive drugs you take.

Under the Inflation Reduction Act, Part D enrollees have the option to spread their drug costs out across the year in equal monthly payments starting in 2025. This could be a good alternative for some enrollees who take expensive medications and would otherwise meet the $2,000 out-of-pocket limit within the first few months of the year. If you’re in that situation, you can reach out to your Part D plan and discuss the Medicare Prescription Payment Plan option.

As an additional safeguard, your Medicare prescription drug insurer must generally offer enrollees a one-time 30-day refill of their current medications when the person has recently switched plans or their plan benefits change from one year to the next. Because there are conditions attached to this policy, known as a “transition fill,” you should be sure to know your insurer’s rules – while ensuring the plan follows through on its obligations to support you as a Medicare beneficiary.

4. It pays to shop around.

Even without major coverage changes, new and different offerings can come to your area, so it still pays to shop around for new plans.

And for 2025, the Medicare Part D benefit improvements under the Inflation Reduction Act could also result in a reduced number of plans in some areas, or more significant benefit and premium changes than we’ve tended to see in the past. The federal government has introduced premium stabilization measures for stand-alone Part D plans. But enrollees will need to pay close attention to any notifications they receive from their plan as we head into the annual election period, and should also consider whether any of the other available options might be a better choice for 2025.

This is applicable regardless of whether a person has a stand-alone Part D plan or a Medicare Advantage plan with integrated Part D coverage. Shopping around each year is the best way to ensure that you’re getting the coverage that best fits your needs. And that’s especially true with the Part D changes that are coming for 2025.

5. Part D premiums aren’t everything.

Part D premiums aren’t the whole story – but they are a big part of it. Benefits under Part D change from year to year — and that’s particularly true for 2025 — so it pays to closely examine your costs under each plan available. Some plans offer generic drugs without copays; if those offerings apply to your medications, you could save a lot of money throughout the year.

In addition, some Part D plans offer enhanced coverage beyond a minimum level of prescription drug benefits required of insurers by the federal government. In 2025, the minimum coverage levels include a deductible of no more than $590, and then out-of-pocket costs that don’t exceed 25% of the cost of brand-name and generic drugs. But some Part D plans have lower deductibles or no deductibles at all, and some plans offer lower out-of-pocket costs after the enrollee meets the deductible. These enhanced benefits will continue to be an option for insurers to offer in 2025.

As good as that sounds, enhanced Part D plans may not end up being the best choice — their higher premiums might more than negate the savings offered by the lower co-pays and deductibles the enhanced plans advertise. This is why it is so important to consider your costs across the entire year, including premiums, co-pays and co-insurance, before deciding on next year’s Part D plan.

Using Medicare’s plan comparison tool (rather than a third party’s tool) allows you to hold Medicare and the Part D plan accountable – and change plans during the benefit year – if you rely on plan information Medicare.gov shares with you to decide on a health plan, and that information (such as whether the plan covers a certain medication) turns out to be inaccurate. You should be able to ask to change to another plan during the year, if you keep proof that Medicare.gov or the plan gave you incorrect information when you were selecting your current plan.

6. Have a lower income? You might qualify for better benefits.

Low-income members, including those who have both Medicare and Medicaid, can wind up with different benefits. This is important.

You probably know if you have Extra Help (also known as the Low-Income Subsidy or “LIS”) with your Part D coverage, your copays in 2024 are no more than $4.50 for generics and $11.20 for brand-name drugs. And starting in 2024, the full Extra Help benefit is available to people with income between 135% and 150% of the federal poverty level, whereas before 2024 these beneficiaries only qualified for partial Extra Help.

There is more information here on programs that can help you save on your Medicare prescription drug costs and apply for government programs that can help you if you’re in need. It’s important to note that, in addition to having better coverage with lower copays, Part D members with Extra Help also have the ability to change plans up to once per month – even outside of open enrollment.

This doesn’t mean you shouldn’t be proactive about choosing a plan that covers your medications during the regular open enrollment window for Medicare each fall, but it does mean you have some flexibility if something does come up mid-year and you need to change plans again.

7. Part D plan quality is in the stars.

Pay attention to Star Ratings when selecting your plan. Although your primary focus should be whether your medications will be covered, the federal government’s Star Ratings program shows how well a Medicare Advantage or Part D plan is doing in several ways that impact you.

Good star ratings – especially ratings of four stars and above – can mean a plan has demonstrated quality customer service and has a track record of paying attention to enrollees’ healthcare needs (such as periodic screenings or health assessments for Medicare Advantage members). By that same token, you should be wary of plans with fewer than four stars. Those plans may have a track record of mistreating their members, providing subpar customer service, and being slow to process member claims and appeals – delaying or even preventing access to needed health care.

In other words, just be savvy.

The best way to select a Part D plan is to pay attention and be a savvy shopper. You can ask for help doing this – from a friend, neighbor, family member – or an advocate you can access through your senior center or Social Services office.

By taking advantage of resources available to you free of cost, you can be confident you’ll have access to your medications and health care providers, while knowing you selected a plan for next year that is more likely to take care of your needs. Seniors and people with disabilities deserve no less.

Josh Schultz has a strong background in Medicare and the Affordable Care Act. He managed a Medicare ombudsman contract at the Medicare Rights Center in New York City, and represented clients in extensive Medicare claims and appeals.

In addition to advocacy work, Josh helped implement federal and state health insurance exchanges at the technology firm hCentive. He also has held consulting roles, including as an associate at Sachs Policy Group, where he worked with insurer, hospital and technology clients on Medicare and Medicaid issues.

Contributions to healthinsurance.org and medicareresources.org represent only his own views.

Footnotes