Your newfound freedom and your Medicare coverage

For most Americans, turning 65 means gaining access to Medicare. And if you’re retiring, it might also mean a newfound freedom to travel more – perhaps even establishing homes in more than one area and trying out the “snowbird” lifestyle. But if you do that, how will it affect your health coverage?

The good news is that you may find that Medicare’s nationwide coverage makes it easier to be location independent than it would have been with your pre-Medicare coverage, depending on that plan’s network and coverage area. But there’s still plenty to keep in mind when you’re figuring out how your Medicare coverage will work in another part of the country.

First of all, do you have (or plan to get) Original Medicare or a Medicare Advantage plan? Original Medicare provides nationwide coverage, whereas Medicare Advantage plans have provider networks that are typically limited to a local area (the vast majority of Medicare Advantage plans are HMOs or local PPOs). But there are Medicare Advantage plans that work well for snowbirds, and Original Medicare beneficiaries need to understand how their supplemental coverage will work when they’re away from home.

Medicare Advantage if you live in more than one area

If you have a Medicare Advantage plan and it has in-network providers in the area where you plan to have your “home away from home,” that might be all the coverage you need. Even if the plan doesn’t have in-network providers in that area, if it’s a PPO or HMO-POS – and you’re ok with the higher out-of-pocket costs you’ll incur with an out-of-network provider – it might still be a good option for your coverage.

In addition, some insurers offer Medicare Advantage plans that are specifically designed for snowbirds, with coverage available in more than one location – as long as the member contacts the insurer each time they travel from one home to the other. If you have Medicare Advantage coverage or are considering an Advantage plan, you’ll want to find out in advance how the coverage will work when you’re traveling for an extended period of time.

You can switch from one Medicare Advantage plan to another during the annual election period in the fall (October 15 to December 7) or during the Medicare Advantage open enrollment period (January 1 to March 31), and there is significant variation from one plan to another in terms of network size. If you’re going to be traveling extensively, pay close attention to the provider networks of the various plans available in the area where you have your primary home.

Almost nine out of ten Medicare Advantage plans include prescription drug coverage, and the majority of plans include extras like dental and vision coverage, so most Medicare Advantage enrollees do not need additional supplemental coverage. But if your plan includes prescription and dental coverage, you’ll want to make sure you’ll be able to obtain medications or see a dentist when you’re away from your primary home (mail-order pharmacy services can be very useful if the health plan doesn’t have any brick-and-mortar pharmacies near your home-away-from-home).

Medicare Cost Plans

Nearly all Medicare beneficiaries with private coverage have Medicare Advantage plans, but some beneficiaries in a few states have a Medicare Cost Plan. This is another type of private Medicare coverage that works particularly well for beneficiaries who travel extensively. (Minnesota’s large population of snowbirds is part of the reason Medicare Cost Plans have been so popular there.)

New federal rules that took effect in 2019 restrict the availability of Cost Plans to areas where there isn’t significant competition from Medicare Advantage plans, so Cost Plan availability is even more limited than it was prior to 2019.

As of 2023, there were Medicare Cost plans available to individuals in various areas of Minnesota, Wisconsin, Iowa, South Dakota, and North Dakota.

To see if there are Cost plans available in your area, you can enter your zip code on the Medicare plan finder website, and then select Medicare Advantage plans. If there are Cost plans available, they will be displayed alongside the Advantage plans, and the search tool will note that they are Cost plans.

Original Medicare if you live in more than one area

If you have Original Medicare, you’ll probably want supplemental coverage to help pay Original Medicare’s out-of-pocket costs, as Original Medicare on its own does not have a cap on out-of-pocket costs. Nearly nine out of ten Original Medicare beneficiaries have supplemental coverage, either from an employer-sponsored plan, Medicaid, or a Medigap plan.

Supplemental coverage from Medicaid includes Part D prescription drug coverage, and supplemental coverage from employers generally includes coverage for prescription drugs. But Medigap plans sold since 2006 do not include drug coverage. Medicare beneficiaries can purchase stand-alone Medicare Part D prescription coverage if they don’t have creditable prescription coverage from another source.

Your Original Medicare will cover you anywhere in the nation. You’ll just need to make sure that the doctors and hospital you select in your secondary location are participating providers with Medicare. (Virtually all hospitals are, and so are most doctors — but not all of those doctors are accepting new patients.)

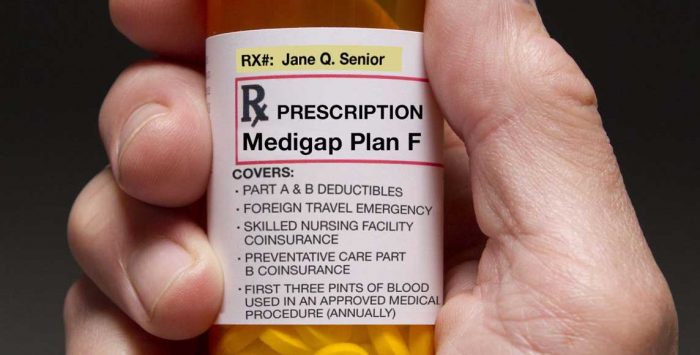

If you’re going to buy a Medigap plan, you’ll select from among the plans available for purchase in your primary location. A Medigap plan will provide supplemental coverage anywhere in the country, as long as the doctors and hospitals you visit accept Medicare.

If you have your supplemental coverage via Medicaid or an employer-sponsored plan, you’ll want to check with the plan for specifics about how your coverage will work when you’re traveling or at your second home.

Medicare is a federal program, but Medicaid is jointly run by the federal government and each state’s government, which means Medicaid differs from state to state. Federal Medicaid rules require Medicaid to pay for services received in another state in certain circumstances. (For a snowbird, this is basically limited to emergencies and situations in which the person’s health would be endangered if they had to return to their home state to receive care). In other situations, Medicaid will probably not cover you outside your home state.

Out-of-state coverage under an employer-sponsored supplemental plan will depend on the specifics of the plan and the provider network it uses. This varies from plan to plan, so check with yours to make sure you understand how the coverage will work.

If you purchase a Medicare Part D plan to provide prescription drug coverage, be sure you understand the plan’s pharmacy network. Part D plans are purchased based on your primary location, but many have extensive pharmacy networks that will allow you to fill prescriptions in other areas.

Some people prefer to fill their prescriptions before they head out on their travels, or use their plan’s mail-order pharmacy. You’ll want to sort out all of these details before you travel. You definitely don’t want to find out at the last minute that you can’t fill a prescription at your second home.

Medicare and international travel

Want to see the world with your newfound freedom from the “9 to 5”? If your travel plans are going to take you outside the United States, you’ll want to pay particularly close attention to the details of your health coverage.

Here’s an overview of international travel for Medicare beneficiaries.

Louise Norris is an individual health insurance broker who has been writing about health insurance and health reform since 2006. She has written dozens of opinions and educational pieces about the Affordable Care Act for healthinsurance.org. Her state health exchange updates are regularly cited by media who cover health reform and by other health insurance experts.

Footnotes