If you’re like most Medicare enrollees, you probably aren’t planning to make any changes to your existing coverage for the coming year. But – like most beneficiaries – you should probably at least consider it during Medicare’s open enrollment period.

And if you’re enrolled in Medicare Advantage (even if you just signed up for it during the most recent open enrollment period), you have a three-month window at the start of the year when you can make changes to your coverage.

The annual open enrollment period runs from October 15 to December 7. Any changes you make during this period will take effect on January first. The Medicare Advantage open enrollment period runs from January 1 to March 31. You’re only allowed to change your coverage once during this window, and the change will take effect the first of the following month.

Planning to stay put?

A recent Kaiser Family Foundation analysis found that only about 10% of Medicare Part D (prescription drug coverage) enrollees switched plans from 2016 to 2017, while 90% remained in the same plan.

Similarly, only 8% of Medicare Advantage enrollees voluntarily switched to a different plan from 2016 to 2017, and less than 1% of Medicare Advantage enrollees opted to switch back to Original Medicare that year. And these numbers are even lower than they were a few years earlier.

Clearly, most enrollees are either happy with their coverage – or possibly unaware of the alternatives that are available – or they’re daunted by the process of selecting and enrolling in a different plan.

But as we point out in the examples below, the possibility that your Medicare coverage will be changing in some way – or that there are new, improved coverage available – makes it well worth your time during open enrollment to compare the options that are available to you for the coming year. And if you have Medicare Advantage, you get another — even longer — opportunity to switch to a different plan after the start of the year.

Even after looking at the other available options, you may end up keeping the coverage you already have. But you might very well find that another plan is a better fit for your needs.

Here are four ways you can change your Medicare coverage. If you have Medicare Advantage, you can still make a change to your coverage after the start of the year, during the January – March Medicare Advantage open enrollment period. Otherwise, changes are limited to the October 15-December 7 window each fall.

1. Pick a different Medicare Part D plan

Medicare Part D covers prescription drugs for people who are enrolled in Original Medicare, or in some cases, Medicare Advantage plans that don’t include prescription coverage. (89% of Medicare Advantage plans have integrated Part D coverage. But if you enroll in a Medicare Private Fee-for-Service plan (PFFS) or Medicare Medical Savings Account (MSA) plan, you’re allowed to purchase a stand-alone Part D plan to supplement it.) As of 2022, about 23.4 million people were enrolled in stand-alone Part D plans.

Or call

866-445-0071 (TTY 771) to speak to a licensed insurance agent.

(Mon-Fri 8am-9pm, Sat 10am-7pm ET)

During the annual open enrollment period (October 15 to December 7), Part D enrollees have a chance to switch to a different Part D plan, enroll in Medicare Part D for the first time if they didn’t enroll during their initial enrollment period (late enrollment penalties may apply), or drop their Part D coverage altogether.

And during the January – March Medicare Advantage open enrollment period — if you have Medicare Advantage coverage — you can switch to a different Medicare Advantage plan that has different drug coverage, or you can switch to Original Medicare and select from among any of the stand-alone Part D plans in your area.

But what if you already have a Part D plan that you like? You still need to pay attention to the options that are available during open enrollment, and any changes that apply to your current plan for the coming year.

Your plan’s premium will likely change for the coming year, and the benefit design of your plan – including the deductible, copays, and coinsurance – could also be changing. (The maximum allowable deductible for Part D plans generally increases each year, so keep an eye out to see if your plan’s deductible will be increasing; the maximum allowable deductible is $480 in 2022, and will be $505 in 2023.) Your plan’s formulary (covered drug list), and the formularies of the other plans available in your area, could be changing too.

And your own medical circumstances might be different from last year, which is just as much of a consideration. I know this because I’ve seen it firsthand:

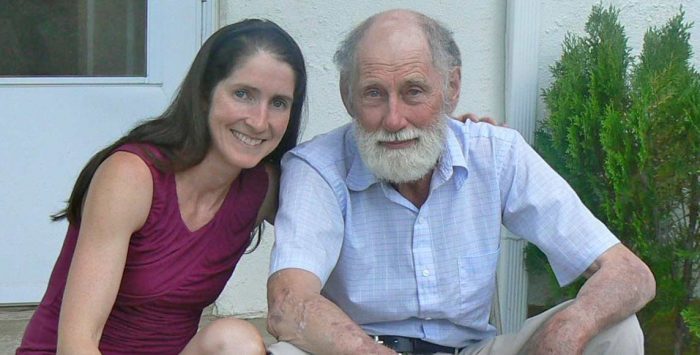

My dad’s kidneys failed when he was 54. (You can read his story here.) He’s had Medicare Part D ever since it became available in 2006. For the first several years, he was on dialysis, and numerous accompanying medications, many of which were quite expensive. To cover them, he always selected one of the most expensive Part D plans, because the higher premiums were far offset by the lower prices he had to pay for the medications.

He was fortunate enough to have a successful kidney transplant in 2012, and needs very little in the way of medications now, other than immunosuppressants. (Medicare Part B covers those for enrollees who are 65+ and had Medicare coverage at the time of the transplant.) So during the open enrollment period following his transplant, he switched to a lower-cost Part D plan, and has maintained coverage ever since in one of the lowest-cost plans available in his area.

The take-away point here is that the plan that worked best for you this year isn’t necessarily the same one that will work best next year. During open enrollment, you can use Medicare’s plan finder tool to compare plans based on the specific prescriptions that you take.

Many Medicare beneficiaries find the shopping process overwhelming, and end up just keeping their existing plan to avoid the hassle. But there are assisters online, over the phone, and in your community who can help you, free of charge. Seek them out if you have questions.

Want to make changes to your Medicare coverage? Talk with a licensed advisor at 1-844-309-3504.

2. Pick a different Medicare Advantage plan

The popularity of Medicare Advantage plans has been growing steadily over the last decade. Almost 46% of Medicare beneficiaries were enrolled in Medicare Advantage plans in 2022, up from about 13% in 2004.

If you’re among the more than 29 million people who have coverage under a Medicare Advantage plan, open enrollment gives you the opportunity to switch to a different Medicare Advantage plan, including switching from one that doesn’t include prescription drug coverage to one that does, or vice versa.

And Medicare Advantage enrollees have more time than Original Medicare beneficiaries to pick a different plan, since they can also take advantage of the Medicare Advantage open enrollment period during the first quarter of each year. Only one plan change can be made during that window, but it allows Medicare Advantage enrollees an opportunity to switch to a different Advantage plan (or switch to Original Medicare).

The average premium for Medicare Advantage plans is about $19/month in 2022, including the fact that the majority of Medicare Advantage enrollees pay no premiums at all other than their Part B premiums (Medicare Advantage premiums are in addition to Medicare Part B premiums). But premiums can vary from one year to another — for the plan that you have, as well as the other options available in your area. Your benefits and provider network might also change, and the same could be true of the other plans that are available to you.

The plan you have now might have been the best option when you first enrolled, but don’t assume that will always be the case. Take the time to compare the various options during open enrollment.

3. Switch from Medicare Advantage to Original Medicare

What if you’re one of those 29 million people on Medicare Advantage and you’ve decided you want to switch to Original Medicare? Open enrollment is an opportunity to do so, and so is the Medicare Advantage open enrollment period at the start of the new year.

But if you’re in poor health, you’ll also want to check into the availability of Medigap plans (Medicare supplemental coverage) before making the decision to switch to Original Medicare.

As Wendell Potter explains, people who are switching from Medicare Advantage to Original Medicare are often those who are experiencing serious medical issues (and conversely, a Kaiser Family Foundation analysis found that people who switch from Original Medicare to Medicare Advantage tend to be those who already have lower health care costs). Although you’ve got the right to switch to Original Medicare during open enrollment and during the Medicare Advantage open enrollment period, you don’t necessarily have access to a Medigap plan without medical underwriting in most states.

There are some exceptions, but this is an area where you’ll want to do your homework before making a decision, as your out-of-pocket costs under Original Medicare (without a Medigap plan) could be significant, depending on your healthcare needs.

4. Switch from Original Medicare to Medicare Advantage

Maybe you’re part of the majority of Medicare beneficiaries who have Original Medicare, but you want to give Medicare Advantage a try (as noted by Kaiser Family Foundation, this transition is more likely among people who tend to have lower health care spending). During open enrollment, you can switch to any Medicare Advantage plan available in your area.

Once you switch, you’ve got a one-year “trial period” during which you can switch back to Original Medicare and still have access to guaranteed-issue Medigap coverage — assuming you had a Medigap plan before you switched to Medicare Advantage and this was your first time switching to a Medicare Advantage plan.

The trial period provision makes it easier to try out Medicare Advantage, but it’s still important to read the fine print before you decide. You may be enticed by a zero-premium plan (keeping in mind that you’ll still have to pay premiums for Medicare Part B), but be sure to account for the scope of the provider network, and the out-of-pocket exposure.

Medicare Advantage plans can have maximum out-of-pocket limits as high as $7,550 in 2022, (most plans tend to have out-of-pocket limits that are lower than that), and that does not include out-of-pocket costs for prescription drugs under an integrated Part D benefit. So keep the big picture in mind when you’re considering possible options for the coming year.

Regardless of the specifics of your situation, you owe it to yourself to check into the options that are available during open enrollment. If the options seem overwhelming, you can talk with an agent licensed to discuss Medicare coverage by calling one of our enrollment partners at 1-844-309-3504.

Louise Norris is an individual health insurance broker who has been writing about health insurance and health reform since 2006. She has written dozens of opinions and educational pieces about the Affordable Care Act for healthinsurance.org. Her state health exchange updates are regularly cited by media who cover health reform and by other health insurance experts.