What is a special income limit (SIL)?

Although Medicare does not cover custodial long-term care services, Medicaid does. Medicaid pays at least some of the costs for about 80 percent of U.S. nursing home residents. Due to the high cost of long-term care, most states have a “special income limit” for Medicaid long-term care benefits that is higher than for other Medicaid programs.

This limit is set as a percentage – usually 300 percent – of the Supplemental Security Income (SSI) payment amount. In 2020, three times the SSI payment is $2,349 a month.

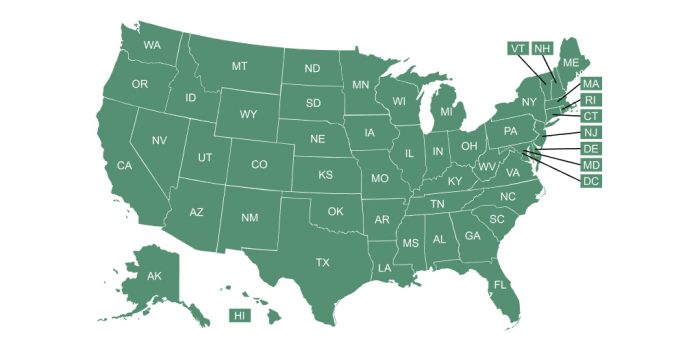

As of 2018, 42 states used a SIL to determine eligibility for Medicaid nursing home benefits, and 43 states used this limit for HCBS programs. The SIL is $2,349 a month (in 2020) in every state except Delaware, where it is 250 percent of the SSI payment rate, and Missouri, where it varies based on the program.

The SIL is higher than the income limit for other Medicaid benefits for aged and disabled individuals — which usually isn’t more than the poverty line, or a monthly income of $1,064 for individuals and $1,437 for spouses.

Using a SIL for Medicaid nursing home benefits does not mean enrollees can keep all of their income below this limit – because most of it must be paid toward their care. But some states allow HCBS recipients to keep all of their income up to the SIL.

Tags: long-term services and supports