What is Medicare Part D?

Medicare Part D is prescription drug coverage that subsidizes the costs of prescription drugs for Medicare beneficiaries. Enrollees pay a monthly premium (depending on how they get their coverage, this can be as low as $0/month), and cost-sharing that varies from plan to plan. It’s common for the cost-sharing to include an annual deductible and then copays or coinsurance each time a prescription is filled.

Medicare recipients can obtain Part D coverage by enrolling in either a stand-alone prescription drug plan (PDP) – which covers only prescription drugs – or a Medicare Advantage plan with integrated Part D coverage, which covers prescriptions and other medical expenses.

What does Medicare Part D cover?

Medicare Part D covers self-administered outpatient prescription drugs and certain vaccines, including Tdap and shingles vaccines. Medicare Part D is designed to cover prescription drugs that aren’t covered under Medicare Part A or Part B. Medicare beneficiaries have coverage under Medicare Part A for drugs that are administered during an inpatient stay, and under Part B for certain vaccines and most drugs that aren’t self-administered (meaning they are generally administered in a clinic via infusion or injection).

How many people are enrolled in Medicare Part D?

As of 2024, more than 54 million Medicare beneficiaries had prescription drug coverage through Medicare Part D. The total includes about 31 million who have Part D coverage in conjunction with a Medicare Advantage plan (ie, a Medicare Advantage prescription drug plan — MAPD), and about 23 million who have stand-alone Part D prescription drug plans (PDPs), most of which are purchased to supplement Original Medicare.

Or call

866-472-0949 (TTY 771) to speak to a licensed insurance agent

(Mon-Fri 8am-9pm, Sat 10am-7pm ET)

The Inflation Reduction Act, which was enacted in 2022, is making significant improvements to Medicare Part D coverage, with changes that began to phase in as of 2023. Some Part D enrollees have lower drug costs, and all Part D enrollees are now eligible for zero-cost vaccines. In 2025, Part D enrollees will pay no more than $2,000 in out-of-pocket costs for drugs covered under their Part D plan.

How do Medicare enrollees get Medicare Part D prescription drug coverage?

All prescription drug coverage for Medicare beneficiaries is provided by private insurance companies, as Medicare Parts A and B (ie, Original Medicare) don’t cover most outpatient prescriptions. The exception is infusion drugs provided in a doctor’s office or via medical hardware like an insulin pump; those medications are covered under Medicare Part B. And drugs taken during an inpatient hospital stay are covered under Medicare Part A. But outpatient prescription drugs are generally not covered under Original Medicare, which is why Medicare Part D is an important part of an enrollee’s overall coverage.

Most Medicare Advantage plans do include prescription drug coverage (89% do so for 2024). If you’re enrolled in a Medicare Savings Account (MSA) plan or Private Fee-for-Service (PFFS) plan that doesn’t include Part D coverage, you have the option to enroll in a stand-alone Part D plan to supplement your coverage. Otherwise, Medicare Advantage enrollees who want prescription drug benefits need to enroll in a Medicare Advantage plan that has integrated Part D coverage.

People with Original Medicare can choose from among any of the available stand-alone Part D plans (PDPs) in their area. Some Medicare beneficiaries have creditable drug coverage from a current or former employer, and thus do not need to enroll in Part D.

When and how do I enroll in Medicare Part D?

The first opportunity for Medicare Part D enrollment is when you’re initially eligible for Medicare. For people who are aging into Medicare, this means during the seven-month period beginning three months before the month you turn 65.

If you enroll before the month you turn 65, your prescription drug coverage will begin the first of the month you turn 65. If you enroll during the month you turn 65 or one of the three following months, your prescription coverage effective date will be delayed — it will not be retroactive to the month you turned 65.

If you enrolled in Medicare due to a disability, you may enroll during a seven-month window beginning three months before your 25th month of disability. If you enroll in the three months before your 25th month of disability, your coverage will begin the first day of the 25th month (meaning the same month your Medicare coverage begins). If you enroll during the 25th, 26th, 27th, or 28th month of disability, your coverage will begin the first of the month after you enroll (note that the effective date rules are different if a person is enrolling in Medicare due to a diagnosis of ALS or end-stage renal disease).

In both of these cases – whether you’re turning 65 or are eligible for Medicare because of a disability – you have the option of selecting a Medicare Advantage plan that includes prescription drug coverage, and using that in place of Medicare A, B, and D. The enrollment periods and rules are the same as those described above for stand-alone Medicare Part D plans.

After you’ve chosen from the various PDP offerings, you can enroll by:

- calling 1-800-MEDICARE to locate PDPs in your area

- logging in to Medicare’s Prescription Drug Plan Enrollment Center

- filling out the paperwork sent by mail from Medicare, or

- calling the private insurer with the specific PDP you want to join.

Once you apply for Medicare Part D, it can take a few weeks for your membership card to arrive. If your coverage effective date has already passed but you haven’t received your membership card, most pharmacies will accept the initial letter you received from Medicare acknowledging your upcoming membership, or an enrollment confirmation number.

Call 1-844-309-3504 now to discuss your Part D coverage options with a licensed advisor.

Can I enroll in Medicare Part D after my initial enrollment period?

In most cases, enrollment outside of your initial enrollment period is limited to an annual enrollment period between October 15 and December 7, with coverage starting January 1 of the following year. During this time, you can enroll in a new PDP or MAPD plan, and coverage is guaranteed issue. If you already had Part D coverage under another plan, the new plan will automatically replace the old one, so you don’t need to do anything other than enroll in the new plan.

If you don’t already have Part D coverage, you can use the fall open enrollment period to sign up for it. But you might be subject to a late enrollment penalty.

If you are enrolled in a Medicare Advantage plan and want to switch to Original Medicare, you can do so either during the fall open enrollment period (October 15 – December 7) or during the Medicare Advantage open enrollment period (January 1 – March 31). If you do so, you’ll also have the option to purchase a Part D plan at the same time, so that you’ll have prescription coverage to go along with your Original Medicare coverage.

Can I delay enrollment in Part D coverage?

If you didn’t enroll in prescription drug coverage – either through a PDP or a Medicare Advantage plan – during your initial open enrollment window and then you enroll during an open enrollment period in a future year, there’s a late enrollment penalty that will be added to your premium. But the late enrollment penalty does not apply if you delayed your Part D enrollment because you maintained creditable drug coverage from another source — like an employer-sponsored health insurance plan.

The Part D late enrollment penalty would also apply if you drop your prescription coverage for more than 63 days and then re-enroll during the open enrollment period. It’s important to maintain continuous drug coverage from the time you’re first eligible, both to protect against significant prescription costs, and also to avoid higher premiums when you ultimately re-enroll.

How much does Medicare Part D cost?

The average stand-alone Part D plan costs $41.63/month in 2024, and that is projected to decrease to $40/month in 2025.

But the plans are issued by private insurers, and there’s significant variation in terms of the benefits, the formularies (covered drug lists), and the pricing. Among the stand-alone Part D plans available for 2024, premiums range from under $1/month to more than $200/month (for plans that are available nationwide, average premiums range from under $1/month to $108/month) But monthly premiums are much lower for MA-PDs than they are for PDPs.

High-income enrollees (for 2025, that’s defined as those with income above $106,000 for a single individual or $212,000 for a married couple) pay extra for their Part D coverage. In 2024, the additional premiums — added to the regular amount that the Part D insurer charges — range from $12.90/month to $81/month (these amounts change each year). This amount is added to the premium regardless of whether the high-income enrollee selects a PDP or an MA-PD.

The premium adjustment for high-income enrollees is based on income tax returns from two years prior, since those are the most recent returns on file at the start of the plan year. (So for example, 2023 tax returns are used to determine whether you pay an increased Part D premium in 2025). There’s an appeals process you can use to contest the income-related premium adjustment if you’ve had a life-change event that has subsequently reduced your income.

Part D out-of-pocket costs

In addition to the premiums, you’ll pay a copay (fixed cost) or coinsurance (a percentage of the cost of your medications) for drugs, and it’s also common for plans to have a deductible that must be met before the plan start to pay for medications (some drugs are not subject to the deductible, including recommended vaccines and insulin).

Out-of-pocket costs for drugs covered under a Medicare Part D plan are capped at $2,000 in 2025. Out-of-pocket costs under Medicare Part D used to be unlimited, but that has changed as a result of the Inflation Reduction Act. Starting in 2024, the IRA eliminated out-of-pocket costs once a person reached the catastrophic coverage level. And for 2025, the $2,000 out-of-pocket cap applies (indexed for inflation in future years).

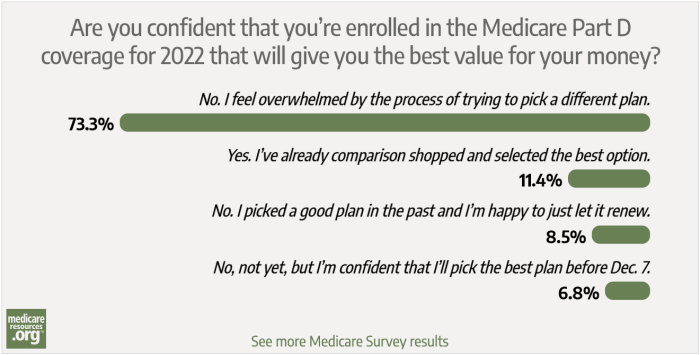

Your out-of-pocket costs will depend on the plan you choose, based on your individual medical needs. Be sure to look beyond the plan’s premium and consider all costs. You can use Medicare’s plan finder tool to help you select the best drug plan to meet your needs. This is a process that you’ll need to repeat each year during open enrollment, as drug formularies (covered drug lists) change along with premiums from one year to the next.

How do I pay the Part D premium?

Once you select a PDP, there are four ways to pay the premium:

- deducted from your bank account;

- charged to credit or debit card;

- billed monthly; or

- deducted from your Social Security check (You’ll contact your PDP issuer to set this up.)

Is there help if I can't afford my prescription drug costs?

Some Medicare beneficiaries struggle to afford the high cost of prescription drugs. Enrollees with limited incomes and resources can apply for Extra Help (Low-Income Subsidy, or LIS). This federal program dramatically lowers prescription drug expenses under Part D, and the Inflation Reduction Act expanded eligibility for full Extra Help.

The Inflation Reduction Act also created a program, effective in 2025, that allows Medicare Part D enrollees to spread their total drug costs out across the whole year, instead of having to meet the $2,000 out-of-pocket limit in just the first few months of the year. Enrollees can contact their Part D plan to set this up.

State Pharmaceutical Assistance Programs (SPAPs) also provide prescription drug assistance to beneficiaries in some states. These programs can pay for Part D premiums, deductibles and co-pays. Income limits for SPAPs are usually much higher than Extra Help.

Louise Norris is an individual health insurance broker who has been writing about health insurance and health reform since 2006. She has written dozens of opinions and educational pieces about the Affordable Care Act for healthinsurance.org.

Footnotes