What is a Medicare Medical Savings Account (MSA)?

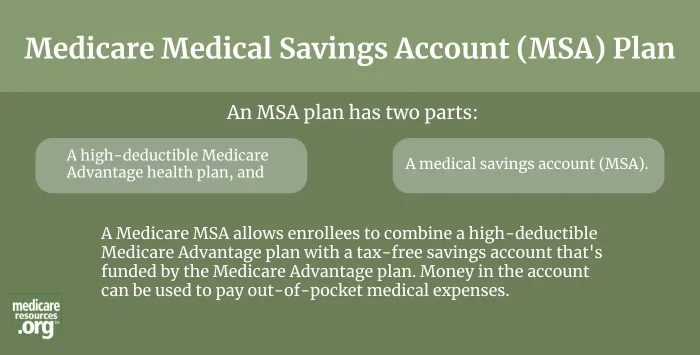

A Medicare Medical Savings Account Plan, also known as a Medicare Advantage MSA, is a type of Medicare Advantage plan that combines a high-deductible health insurance plan with a medical savings account (MSA). MSAs differ from other Medicare Advantage plans in several key ways, which are detailed below.

How do Medicare Medical Savings Accounts work?

An MSA plan has two parts:

- A high-deductible Medicare Advantage health plan, and

- A medical savings account (MSA)

Deposits are made to the MSA by the Medicare Advantage plan using funds that Medicare has given the insurer. Enrollees cannot contribute their own money. The amount that’s deposited into the MSA, and the health plan deductible, will vary from one plan to another. But both are prorated if a person enrolls in a Medicare MSA mid-year.

The person enrolled in the Medicare MSA plan can then use the money in the MSA if they have out-of-pocket medical expenses during the year. MSA withdrawals are not taxed as long as they’re used for qualified medical expenses (and you’ll need to file Form 8853 with your tax return to report your qualified medical expenses). But if the plan holder withdraws the money for anything other than a qualified medical expense, it would be subject to income tax plus a 50% penalty.

Qualified medical expenses are explained in IRS Publication 969 and detailed in IRS Publication 502. They include out-of-pocket costs for Medicare-covered services as well as medical services that aren’t covered by Medicare, such as dental and vision care. Qualified medical expenses also include out-of-pocket costs for drugs covered under a separate Medicare Part D plan.

In some ways, the concept of an MSA plan is similar to the high-deductible health plans (HDHPs) and health savings accounts (HSAs) that are available for people who aren’t yet covered by Medicare. But HSA contributions can be made by an employer, the account owner, or anyone else who wants to contribute money to that person’s account, whereas MSA contributions are only made by the person’s Medicare Advantage plan.

What services does a Medicare Advantage MSA plan cover?

Just like all Medicare Advantage plans, MSA Plans have to cover the same services that are covered by Medicare Part A and Part B.

MSA plans can provide coverage for additional benefits, such as dental, vision, and hearing care, but there may be a premium for this extra coverage. The specifics of extra coverage can vary from one plan to another, so you should check with the plan for details.

What doctors can I see if I have an MSA plan?

Unlike other Medicare Advantage plans, MSA plans do not require you to stay within the insurer’s provider network, if there is one. You can see any doctor who accepts Medicare anywhere in the country – as is the case for anyone enrolled in Original Medicare.

Do Medicare MSA plans include prescription drug coverage?

Unlike most Medicare Advantage plans, MSA plans do not include Part D prescription drug coverage. But you can purchase a separate stand-alone Part D plan in addition to the MSA plan. And beneficiaries are allowed to use money in the MSA to pay out-of-pocket costs under the Part D plan, if they choose to do so.

How do I find an MSA plan in my area?

In most areas of the country, MSAs are not available. They are only available in Wisconsin for 2026, offered by a single insurer (Network Health).

Regardless of where you live, you can use Medicare’s plan finder tool to see what plans are available in your area and if any of them are MSAs. After entering your zip code in the plan finder tool, you’ll select Medicare Advantage plans, skip the question about prescription drug costs, and then you’ll get to a screen where there’s a box near the top that says “Plan Type.” That will have a drop-down menu, and if MSAs are available in your area, they’ll be one of the options in that drop-down menu.

If MSA isn’t listed, it means there aren’t any available where you live. Again, that will be the case for 2026 if you live anywhere other than Wisconsin, as that’s the only state where an MSA plan is available.

When can I enroll in a Medicare Advantage MSA plan?

Just like any other Medicare Advantage plan, the enrollment window to switch to a different plan – including an MSA plan if one is available in your area – runs from Oct. 15 to Dec. 7 each year. This window also allows you to enroll in a stand-alone Part D prescription drug plan, which you’ll need to purchase in addition to the MSA plan since those do not include integrated Part D coverage.

How much are Medicare MSA plan premiums?

There is no separate premium for the Medicare MSA plan. But enrollees pay the Medicare Part B premium ($202.90/month for most enrollees in 2026). And if they want Medicare prescription drug coverage, they also have to pay the premium for a stand-alone Medicare Part D prescription drug plan.

If an enrollee selects a Medicare MSA plan that doesn’t cover dental and vision care, they can choose to purchase stand-alone dental and vision coverage. These plans are not specific to Medicare enrollees, and can be obtained from various insurers. Pricing, coverage details, and plan availability vary.

How high are deductibles on Medicare MSA plans?

The maximum allowable deductible for an MSA is $18,100 in 2026, although plans can have deductibles well below this limit. The only carrier that still offers MSA plans, Network Health in Wisconsin, has a $4,000 deductible for its MSA plan.

MSA plans pay the full amount of enrollees’ costs after they meet the deductible, meaning that the deductible and out-of-pocket maximum will be the same amount.

The insurer’s contributions to the MSA itself will help to reduce the enrollee’s actual out-of-pocket costs, since they can use the MSA money to cover some of their expenses. This amount is set by the plan. The Network Health MSA in Wisconsin (the only MSA available for 2026) contributes $1,750 to each enrollee’s MSA.

Although the only available MSA for 2026 has a deductible far lower than the maximum allowed under federal rules, it’s interesting to note that the maximum deductible limits (and out-of-pocket limits) imposed by the federal government for MSAs are much higher than the overall maximum out-of-pocket limit for other Medicare Advantage plans. For 2026, other (non-MSA) Medicare Advantage plans can’t have in-network out-of-pocket limits above $9,250, and their combined in-network and out-of-network out-of-pocket limit (for plans that cover out-of-network care) can’t be more than $13,900.

But as noted above, MSA plans allow enrollees to use any medical provider who accepts Medicare, nationwide, so there’s more flexibility than there would be with a typical network-based Medicare Advantage plan.

What happens to unused money left in a Medicare MSA at the end of the year?

As is the case with HSAs, unused money remaining in the MSA at the end of the plan year will roll over to the next plan year. If the person keeps the MSA plan, the next year’s deposit will be added to the money that’s already in the account from the prior year’s deposit. But if you leave an MSA plan mid-year, you’ll have to repay a prorated portion of that year’s MSA deposit.

What's the difference between a Medicare Medical Savings Account (MSA) and a Medicare Savings Program?

As described above, a Medicare Medical Savings Account (MSA) Plan is a type of Medicare Advantage plan that combines a high-deductible health plan with a Medical Savings Account funded by the health plan.

A Medicare Savings Program is different, and is a way for low-income Medicare beneficiaries to qualify for Medicaid-funded financial assistance with their Medicare premiums and out-of-pocket costs. Learn how Medicare Savings Programs help with Medicare costs.