What is the Medicare Advantage open enrollment period?

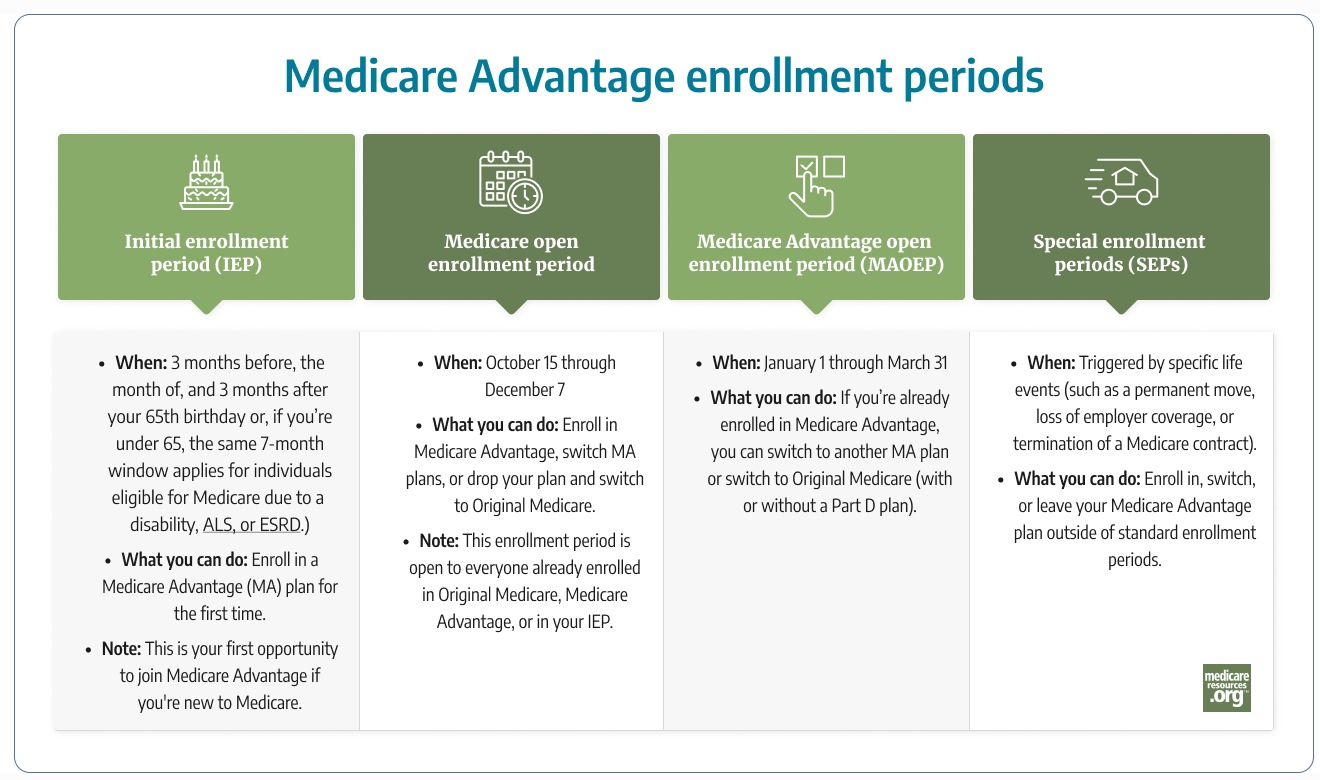

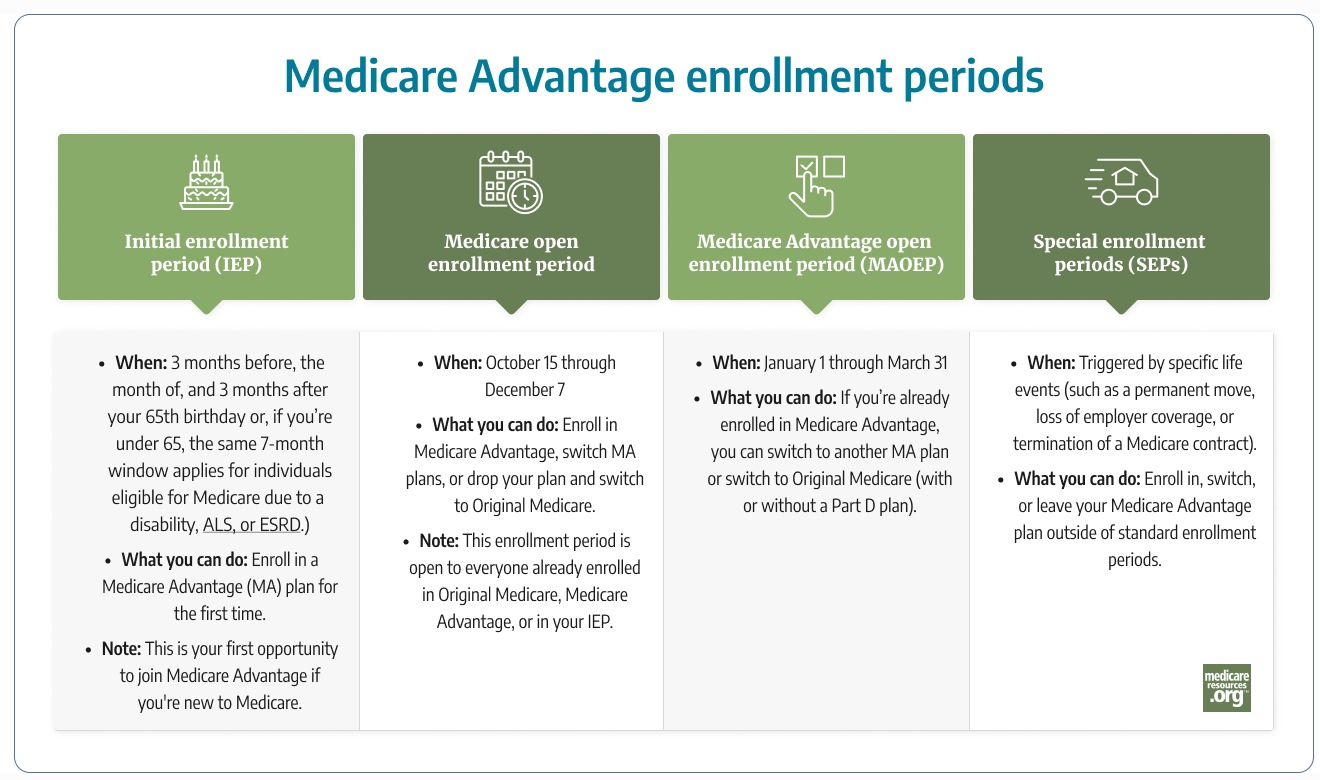

The Medicare Advantage open enrollment period (MAOEP) is an annual opportunity for Medicare Advantage enrollees to switch to Original Medicare or to a different Medicare Advantage plan. This enrollment window – from January 1 to March 31 – can be used by anyone enrolled in Medicare Advantage, allowing a policyholder to make a plan change at the start of the year if their current plan no longer meets their needs.

The MAOEP gives enrollees an opportunity to make a different plan choice if the Medicare Advantage plan they picked during the fall Medicare open enrollment period doesn’t end up meeting their needs. It’s also a chance for a person to make a plan change if they let their Medicare Advantage plan auto-renew and then found out early in the new year that the benefits had changed and the plan would no longer meet their needs.

The MAOEP is a backup rather than a primary plan-change window. Ideally, it’s best to make any plan changes during the fall Medicare open enrollment period, so that the new plan takes effect January 1.

What are the restrictions regarding the Medicare Advantage open enrollment period?

The Medicare Advantage open enrollment period can only be used by Medicare beneficiaries who already have a Medicare Advantage plan. It cannot be used by enrollees with Traditional Medicare – also known as Original Medicare – and it can not be used to make changes to a stand-alone Medicare Part D prescription drug plan.

In addition, a Medicare Advantage enrollee can only make one plan change during the MAOEP.

When will my plan changes take effect?

If you make a plan change during the Medicare Advantage open enrollment period, your new coverage will take effect the first of the month after the month that your request is received by the plan. So if you submit a plan change request on February 20, your new coverage will be effective March 1.

How is the MAOEP different from the Medicare enrollment period?

All of the changes that enrollees can make during the MAOEP can also be made during the Medicare open enrollment period (also known as the annual election period or annual coordinated election period), which runs from October 15 to December 7. But some of the changes that can be made during the Medicare open enrollment period cannot be made during the MAOEP, as it’s a more limited enrollment window.

The Medicare open enrollment period allows Medicare beneficiaries to switch from Original Medicare to Medicare Advantage or vice versa, or to add, drop, or switch to a different Part D prescription drug plan, or to switch from one Medicare Advantage plan to another. Enrollees can make as many plan changes as they like during this window. The last change they make by December 7 will take effect on January 1.

The MAOEP is more limited. It can only be used by those who already have Medicare Advantage coverage, and they can make only one plan change during this window. During the MAOEP, a Medicare Advantage enrollee can switch to a different Medicare Advantage plan, or switch to Original Medicare (and add a Part D drug plan if they wish). But people with Original Medicare cannot make changes during the MAOEP, nor can it be used to make changes to stand-alone Part D drug coverage.

How do I make a plan change during the MAOEP?

If you want to make a plan change during the MAOEP, you can work with a licensed Medicare sales agent in your area who can help you. Alternatively, you can call 1-800-MEDICARE (1-800-633-4227) and tell them what change you would like to make.

If you’re using the Medicare plan finder tool and you see a different Medicare Advantage plan that you’d like to join, you can select “enroll” for that plan. (Enrolling in a new plan will automatically disenroll you from your old plan.) Or you can contact the Medicare Advantage plan that you desire by phone or via its website and ask the carrier to enroll you. You can request a paper application if that’s your preference, but the carrier must receive your application by March 31.

If you’re using the MAOEP to switch to Original Medicare and you want seamless drug coverage, you’ll need to sign up for a Part D prescription drug plan during the same month that you submit your request to switch to Original Medicare. Each request will be processed separately, and will take effect the first of the following month.

So if you submit your request to switch to Original Medicare on January 25 but don’t apply for a Part D plan until February 2, you’ll be without drug coverage in February. Your Original Medicare will take effect February 1, but your Part D coverage won’t take effect until March 1.

Why would someone consider switching or dropping Medicare Advantage?

There are lots of reasons a Medicare Advantage enrollee might want to switch to a different Medicare Advantage plan or switch to Original Medicare. Each person has different needs, preferences, and circumstances, so there’s no right or wrong answer.

If you’re not sure whether you need to switch coverage, these questions may help when considering whether your current Medicare Advantage plan is meeting your needs:

- Are your medical providers in-network with your current plan? If not, does the plan offer out-of-network coverage that you consider affordable?

- Are your prescription drugs covered by the plan, and are there other plans available that would cover your drugs with lower out-of-pocket costs?

- Are you able to access the care you need in a timely manner, without being hampered by prior authorization requirements or other coverage limitations?

There’s a lot to consider when it comes to Original Medicare versus Medicare Advantage. But it’s important to note that if you switch to Original Medicare during the MAOEP, your access to a Medigap plan might depend on your medical history (Medigap plans will pay some or all of the out-of-pocket costs you would otherwise have to pay yourself for services covered by Medicare Part A and Part B. There is no cap on out-of-pocket costs for Medicare Part A and Part B, which is why Medigap provides important supplementary coverage to Original Medicare).

You will have guaranteed-issue access to a Medicare Part D prescription drug plan, but your ability to access guaranteed-issue Medigap coverage will depend on the state where you live and whether you qualify for a Medigap special enrollment period.

Is it better to use the Medicare open enrollment period or the MAOEP to make a plan change?

It’s best to make a plan selection during the Medicare open enrollment period in the fall. First, this will give you three months of experience with your MA plan before the MAOEP closes, if you pick a new MA plan during the fall enrollment window.

The fall enrollment window is when Medicare beneficiaries have the most flexibility in terms of changes they can make, and it also allows you to have a full year of coverage under the new plan – with your new coverage effective January 1.

If you change plans during the MAOEP, your new plan will take effect in February, March, or April, depending on when you sign up. At that point, you’ll start over with a new deductible and out-of-pocket maximum for the new plan. Any medical out-of-pocket costs you paid while covered by your old plan in the early weeks or months of the year will not count towards your out-of-pocket responsibilities under the new plan. (Note that this is not the case for Part D prescription drug out-of-pocket costs, as those will transfer to the new plan; as of 2025, there’s a $2,000 annual cap on out-of-pocket expenses for drugs covered under Part D, which will be indexed in future years. Even a person has coverage under more than one Part D plan in a calendar year, their total out-of-pocket costs for covered drugs won’t exceed $2,000 in total.)

Carefully considering your plan options during the fall Medicare open enrollment period – and picking a new plan if necessary – is the best way to ensure that you have your preferred coverage throughout the coming year.

Louise Norris is an individual health insurance broker who has been writing about health insurance and health reform since 2006. She has written dozens of opinions and educational pieces about the Affordable Care Act for healthinsurance.org.

Footnotes