The process is fairly straight-forward, and in many instances, automated. If you are already receiving Social Security or Railroad Retirement benefits, three months prior to your 65th birthday you will be sent a Medicare Card for Part A and Part B. Part A is automatic and free (assuming you or your spouse have worked at least ten years and paid Medicare payroll taxes).

If you are not already receiving Social Security or Railroad Retirement benefits, you’ll be able to enroll in Medicare starting three months before the month you turn 65. If you enroll during those three months, your coverage will begin on the first of the month that you turn 65. You can also enroll during the month you turn 65, or during the three following months, but the start date of your coverage will be delayed.

Part B outpatient benefits

Part B is not free, and if you’re automatically enrolled in Medicare when you turn 65 and you want to decline Part B, you must contact Medicare. Instructions on how to decline Part B will be included in the materials sent to you three months before you turn 65.

It’s not recommended that you decline Part B unless you have coverage from your current employer or your spouse’s current employer. Part A only covers hospital charges, so it’s not considered sufficient as a sole source of coverage, and there’s a late enrollment penalty for Part B and limited enrollment windows if you initially decline coverage without having employer-sponsored coverage in place.

Here’s more about what you need to know before you decide to delay enrollment in Part B.

Part D prescription benefits

The same seven-month enrollment window applies to Medicare Part D prescription drug plans, but enrollment in those is not automatic.

You can use Medicare’s plan finder tool to see which available plan will provide the best coverage for the medications you take, and then you’ll need to enroll in the plan you select (you can generally do this online, over the phone, or with a paper application). Note that Medicare’s plan finder tool has been updated as of 2019; if you’re accustomed to the old system, you’ll want to allow yourself some additional time to familiarize yourself with the new tool.

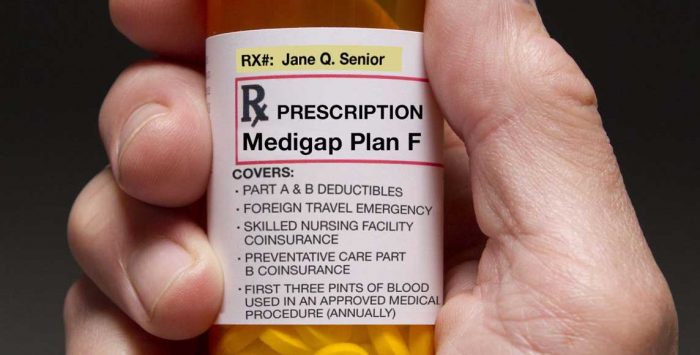

Medigap

Once you’re enrolled in Parts A and B, you have a six-month window during which you can enroll in a Medigap plan. If you miss that window, you may find it difficult or impossible to enroll in a Medigap plan in the future, depending on where you live and how healthy you are.

Medicare Advantage

Or, if you’d rather have a Medicare Advantage plan, you can choose one during the seven-month enrollment window that applies to Medicare Parts A and B. You’ll continue to pay for Part B, although your Advantage plan will wrap all the benefits of Part A, Part B, Part D (in most cases), and various additional benefits into one plan offered by a private insurance company.

Depending on the plan you pick, you may have to pay a premium to the insurance company for the Medicare Advantage plan, or you may be enrolled in a zero-premium Medicare Advantage plan (you still have to pay for Part B, even if the Advantage plan has no premium). More than half of Medicare Advantage enrollees are in zero-premium plans in 2019.

Medicaid or a Medicare Savings Program

Many Medicare beneficiaries have low incomes and assets that also qualify them for Medicaid coverage. Medicaid and Medicare Savings Programs (MSPs) can pay for Medicare premiums, co-pays, deductibles and coinsurance. This page has more information about Medicaid benefits available to Medicare enrollees.

You’ll need to manually cancel your individual-market coverage.

If you’ve got private coverage in the under-65 market, be aware that you’ll need to cancel your previous coverage once you’ve enrolled in Medicare. Talk with your carrier or broker about this to make sure that you don’t double-pay for coverage you don’t need, and to make sure you don’t inadvertently cancel your coverage too soon and end up with a gap in coverage.

If you’re receiving a premium subsidy in the individual market, your eligibility for the subsidy will end when you transition to Medicare. As long as you enroll in Medicare by the end of your initial enrollment period, your premium subsidy will continue until the day before your Medicare coverage starts — even if you enroll at the end of your enrollment window and thus don’t get Medicare until several months after you turn 65.

Louise Norris is an individual health insurance broker who has been writing about health insurance and health reform since 2006. She has written dozens of opinions and educational pieces about the Affordable Care Act for healthinsurance.org. Her state health exchange updates are regularly cited by media who cover health reform and by other health insurance experts.

Tags: Medicare Part A, Medicare Part B