In the summer of 2020, we debuted a series of reader surveys, designed to get a better understanding of our readers’ thoughts on various issues related to Medicare. We started things off by asking readers if they had needed or received help with the Medicare enrollment process – responses were mostly split on that one, with just over half saying that they did need help.

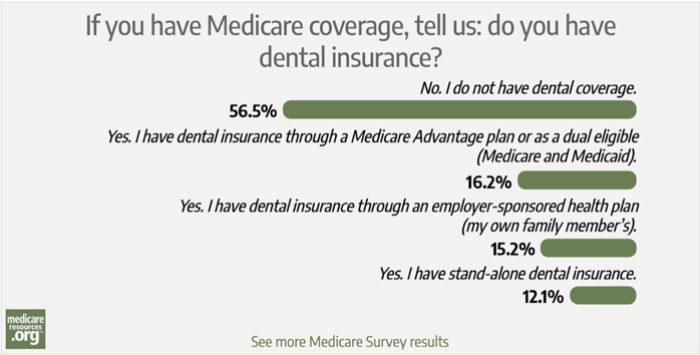

Since then, we’ve covered a wide range of topics, including open enrollment marketing, dental coverage, telehealth, out-of-pocket spending, and annual plan reviews/changes. After nearly two years of surveys, we wanted to share the highlights of what we’ve learned from our readers.

Highlights of our Medicare surveys

So what can we take from all of this? We know that overall, Medicare is very popular, and that beneficiaries tend to be satisfied with their coverage. But our reader surveys highlight some areas of concern, including dizzying plan choices, costs that aren’t always affordable, and a lack of certain benefits, such as dental coverage (and, most recently, at-home COVID tests, which are now free under Medicare.

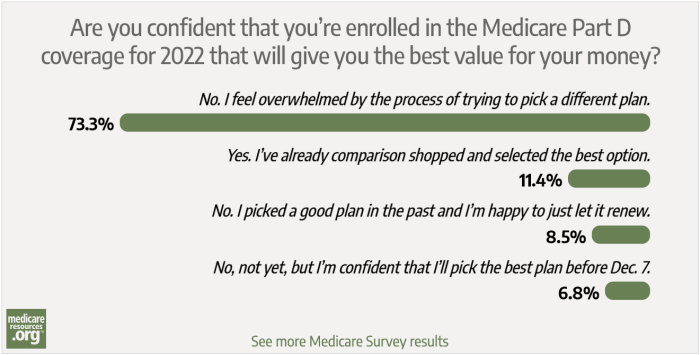

Enrollees are confused about their Medicare coverage options

We’re not surprised to learn that our readers find Medicare coverage options to be overwhelming and confusing. Plan choices for Medicare beneficiaries start with the decision between Original Medicare and Medicare Advantage. In both cases, beneficiaries then need to select from among a variety of private plans for at least some of their coverage.

Beneficiaries who choose Original Medicare need to purchase a private

Part D prescription plan and a private

Medigap plan (unless they have other supplemental coverage in place, such as an employer or union-sponsored plan). Beneficiaries who choose Medicare Advantage need to select a private Advantage plan; depending on where they live, there may be just a few choices or there may be dozens of options.

For 2022 coverage, the average Medicare beneficiary can choose from among 39 Medicare Advantage plans (the specific number varies considerably from urban to rural locations) and 23 stand-alone Part D plans. When Americans are shopping for Medigap plans, there are ten standardized benefit designs in most states, but there can be dozens of insurers offering some or all of the plan designs.

The choice of a Medigap plan is particularly important, because beneficiaries generally just have one six-month window during which they can pick any plan they want, without medical underwriting (meaning that the plan is guaranteed-issue, regardless of their medical history). Beneficiaries can change their mind later on and apply for a new or different Medigap plan, but in most states and most circumstances, eligibility and pricing after that initial six-month window will depend on their medical history.

If coverage for expenses like dental and vision care is important to you, most Medicare Advantage plans provide these benefits, along with various other coverage that goes beyond what Original Medicare provides. And note that you can also purchase stand-alone dental and vision coverage separate from your Medicare coverage. This is a solution that might be useful if you prefer Original Medicare but would still find value in having dental and vision coverage.

Although supplemental benefits can be attractive, it’s important to keep the big picture in mind when deciding what type of Medicare coverage to choose and what specific plans will best fit your needs. Supplemental benefits can be a great addition to your coverage, but you’ll want to make sure the basics are covered first. That means monthly premiums and total out-of-pocket costs that you can afford to pay, coverage for the specific doctors, hospitals, and other medical providers who care for you, and prescription drug coverage that includes your medications on its formulary (covered drug list).

Readers are frustrated by their costs under Medicare

When it comes to costs, our surveys indicated that many of our readers are frustrated with their costs under Medicare, and are spending more than they thought they would. But nearly two-thirds of our readers are paying less than $200/month for their Medicare coverage, which tends to reflect coverage with fairly high out-of-pocket costs.

A person with Original Medicare, Medigap Plan G (the most comprehensive plan available to people who become eligible for Medicare after 2019) and the Part D plan that best fits their prescription needs will generally find that they have very little in the way of out-of-pocket medical costs, but they are likely to be paying well over $300/month in total premiums.

On the other hand, a person with a zero-premium Medicare Advantage plan will pay no more than $170.10/month for their 2022 coverage (and possibly less, if their plan has a “giveback” rebate), but might have an out-of-pocket exposure of several thousand dollars.

As is the case for other types of health coverage, higher premiums will tend to provide more robust benefits, either in terms of network access or out-of-pocket costs or both. This can result in some difficult choices, in terms of paying more every month for better coverage, or paying more if and when medical care is necessary.

Fortunately, Medicare Savings Programs are available for some low-income beneficiaries, and millions of Medicare beneficiaries are simultaneously enrolled in Medicaid. But these programs all have fairly low asset limits in addition to the income requirements.

So some Medicare beneficiaries with low income but modest assets will find that they’re not eligible for the programs that could help to make coverage more affordable. This can be particularly jarring for people who were eligible for expanded Medicaid (which has no asset limits) prior to age 65, but are no longer eligible for Medicaid once they turn 65.

For many in this situation, zero-premium Medicare Advantage plans make sense in terms of the monthly payments, but can sometimes come with substantial out-of-pocket costs when medical care is needed.

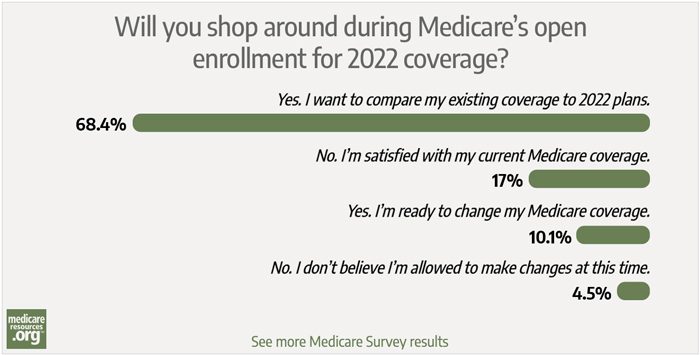

Most understand the importance of reviewing coverage annually, but not everyone actually does it

Beneficiaries with Part D or Medicare Advantage coverage need to reconsider their coverage every year, during Medicare’s annual open enrollment period. And that’s the vast majority of Medicare beneficiaries: There are more than 64 million people with Medicare, and a total of 52 million have stand-alone Part D coverage or Medicare Advantage.

Our surveys indicated that the majority of our readers know that the annual enrollment window is an important opportunity to compare coverage options. But many people find that process — and the marketing materials from insurers — to be overwhelming. And the majority don’t actually review their coverage on an annual basis.

Unlike Medigap, which has standardized benefits that simply keep pace with Original Medicare’s out-of-pocket costs, Part D and Advantage plans can change their benefits from year to year. And as a person’s medical needs change – new prescriptions, new medical specialists, etc. – the Part D or Advantage plan that served them well in the past might no longer be the best option.

The vast majority of Medicare Advantage plans include Part D prescription drug coverage, so Medicare Advantage enrollees need to check their drug coverage options each year in addition to their medical coverage options.

We’re not surprised to see that Medicare beneficiaries feel a bit overwhelmed with their annual plan choices and the marketing materials they receive from insurers each year. But letting an existing plan auto-renew is never in your best interest. If you find the annual enrollment window to be overwhelming, it’s much better to reach out to someone who can help you, rather than simply letting your plan renew from one year to the next. Opting to just keep your plan could result in much higher total costs or more restricted access to providers than you might have had under a new plan.

Help sorting out your coverage options is available

If you or a loved one will soon be eligible for Medicare or need to better understand your annual open enrollment options, help is available. A trusted broker or the local State Health Insurance Assistance Program (SHIP) can help beneficiaries sort through the decision-making process.

And friends or family members can be part of the process too, in order to ensure that the beneficiary clearly understands the decisions and available coverage options.

Louise Norris is an individual health insurance broker who has been writing about health insurance and health reform since 2006. She has written dozens of opinions and educational pieces about the Affordable Care Act for healthinsurance.org. Her state health exchange updates are regularly cited by media who cover health reform and by other health insurance experts.

Tags: Medicare Advantage, Medicare Part D, surveys