What does Original Medicare cost the beneficiary?

Medicare Part A (hospital insurance) is premium-free for most enrollees. If you or your spouse worked at least 10 years in a job where you paid Medicare taxes, you’re eligible for free Medicare Part A when you turn 65. Almost all Medicare beneficiaries — 99% — receive Medicare Part A without having to pay a premium.

Medicare A is also premium-free for people under 65 who have been on Social Security disability for at least two years, or who have end-stage renal disease or ALS.

Medicare Part B has a premium for all enrollees (unless you’re dual-eligible for Medicare and Medicaid, in which case the Part B premium can be paid by your state’s Medicaid program). The premiums are higher for those with high incomes (in 2025, that’s defined as at least an income of more than $106,000 for a single person, based on 2023 tax returns; the threshold is indexed annually).

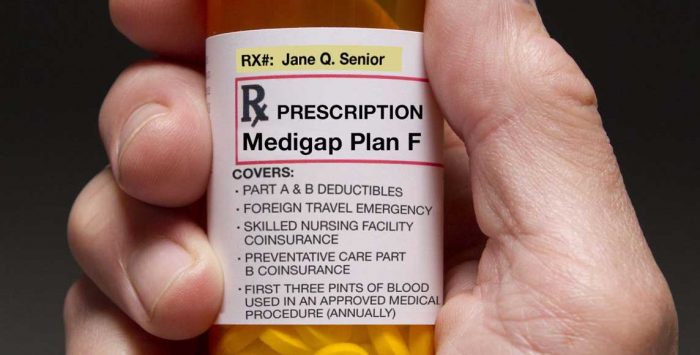

Medicare Parts A and B both have deductibles and coinsurance that are charged if and when the beneficiary receives medical services. Most people with Original Medicare also have supplemental coverage — either from an employer or retiree plan, Medicaid, or privately purchased Medigap plans — which help to pay some or all of the out-of-pocket deductible and coinsurance costs.

Most Medicare beneficiaries also have private Medicare Part D coverage for prescription drugs, either as a stand-alone plan or as part of a Medicare Advantage plan. Employer-sponsored coverage for current employees or retirees can also provide supplemental drug coverage for Medicare beneficiaries.

If you purchase supplemental drug coverage and Medigap, the premiums for those two policies will be in addition to the Part B premiums (and if applicable, the Part A premiums).

What does Medicare Part A cost enrollees?

Although most Medicare beneficiaries receive Part A with no premium, if you do have to pay for it, the premium in 2025 is $518 per month if you worked less than 7.5 years, and $285 per month if you worked between 7.5 and 10 years.

If you’re hospitalized, Medicare Part A has a deductible of $1,676 in 2025 (per benefit period). There is also a copay amount that is charged on a per-day basis after a patient has spent 60 days in the hospital during a single benefit period. In 2025, it’s $419 per day for days 61-90. Each beneficiary has 60 “lifetime reserve days” which can be used if the person still needs to be hospitalized after 90 days in a single benefit period. In 2025, the lifetime reserve coinsurance is $838 per day. All Medigap plans cover these coinsurance charges, plus up to another 365 days of inpatient care after Medicare benefits are exhausted.

(Medicare Advantage plans can have different plan designs in terms of cost-sharing, so the deductible and coinsurance for Medicare Part A isn’t the same as the out-of-pocket costs that a beneficiary pays if they’re hospitalized while enrolled in a Medicare Advantage plan.)

What does Medicare Part B cost enrollees?

Medicare Part B has a standard monthly premium of $185 in 2025, for people who earn up to $106,000 a year ($212,000 for a married couple; note that this is based on income reflected on 2023 tax returns). The premiums are higher if your income exceeds that amount. If an enrollee receives care that’s covered under Medicare Part B, they’ll first pay an annual deductible, which is $257 in 2025.

Some Medigap plans pay the Part B deductible. For people who become eligible for Medicare on or after January 1, 2020, Medigap plans that cover the Part B deductible are no longer available, but people who became eligible for Medicare before that date can continue to have coverage under Medigap Plans C or F, both of which cover the Part B deductible (these beneficiaries can keep those plans if they already have them, or they can apply for coverage under them if they want to change their plan, keeping in mind that medical underwriting is used in most states if you’re applying for a Medigap plan after your initial enrollment period ends).

(As noted above, Medicare Advantage plans can have different plan designs in terms of cost-sharing, so the out-of-pocket costs that an enrollee will pay for outpatient care will be different if they’re enrolled in a Medicare Advantage plan.)

Footnotes

Tags: End Stage Renal Disease, Medicare Part A, Medicare Part B, Medicare premiums, Original Medicare