Which Medicare Part D prescription drug plan should I choose?

Selecting your Medicare Part D prescription drug coverage is an important decision, and one that you need to reconsider every year. There’s a lot that goes into this, so let’s consider some basics to keep in mind:

What's the difference between a PDP and an MAPD?

Medicare Part D coverage is provided by private health insurance carriers, but it can be purchased as a stand-alone Part D prescription drug plan (PDP) or integrated with a Medicare Advantage plan, known as a Medicare Advantage prescription drug (MAPD) plan.

There are PDPs available in all areas of the country, and this is what you need if you have Original Medicare (or a Medicare Advantage MSA or PFFS that doesn’t include prescription coverage) and don’t have supplemental drug coverage from another source, such as an employer’s plan or a retiree plan. If you prefer Medicare Advantage (to take the place of Original Medicare), there are Medicare Advantage plans available in nearly every area of the country in 2024, and 89% of them are MAPDs.

When can I enroll in Part D coverage?

You can enroll in Part D coverage when you first enroll in Medicare. And you’ll also have an annual opportunity during Medicare open enrollment — from October 15 to December 7 — to either enroll in Part D coverage for the first time, or to switch to a different PDP or MAPD.

If you don’t sign up for Part D (either a PDP or MAPD) when you’re first eligible, you could end up paying a late enrollment penalty when you eventually do sign up for Part D, assuming you didn’t have creditable drug coverage from another source during the time you delayed your enrollment. And if you end up with a late enrollment penalty, you’ll have to continue to pay the penalty for as long as you have Part D coverage. The amount of the penalty depends on how long you went without creditable drug coverage, so the longer you wait to enroll in Part D, the larger the penalty gets.

Each year between October 15 and December 7, you have an opportunity to review the PDPs and Medicare Advantage plans (most of which are MAPDs) that are available in your area, and switch to a new one if you choose to do so. If you join a PDP or MAPD plan between October 15 and December 7, your prescription drug coverage takes effect January 1.

What factors are important when choosing Part D coverage?

There are several things to keep in mind when you’re choosing your Part D coverage, including the total cost (premium plus out-of-pocket costs) and whether you prefer Original Medicare or Medicare Advantage, since that’s the first step in deciding whether you’ll need a PDP or an MAPD. (Here are some factors to consider when you’re deciding between Original Medicare + Medigap + a PDP versus Medicare Advantage).

For both PDPs and MAPDs, it’s important to keep in mind that formularies (the covered drug list) can change from one year to the next, so the plan that presented the best value this year might not be the best value next year. In addition, premiums can change from one year to the next, making a plan a better or worse value when compared with the other available options for the coming year. The plan with the lowest premium doesn’t necessarily provide the best value, because you may incur higher out-of-pocket costs when you get your medications.

Medicare.gov has a plan finder tool that lets you enter the medications you take and it will help you sort through the PDPs and MAPDs in your area to determine which ones will provide the best coverage based on your own prescription needs. After entering your medication list, you will be asked to choose a pharmacy. It’s important to choose multiple different retail pharmacies and mail-order options when you’re comparing plans, as pricing can vary from one pharmacy to another, and different pharmacies are in-network with different plans (if a pharmacy is not in-network, your Part D plan won’t cover the cost of medications you obtain there, and the amount you pay won’t count toward your prescription out-of-pocket maximum).

You can also create an account at Medicare.gov, which will pre-populate your medication list for you. Just be sure to remove any one-time prescriptions such as antibiotics.

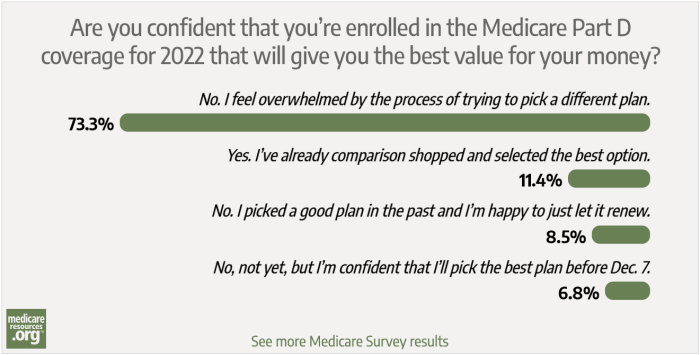

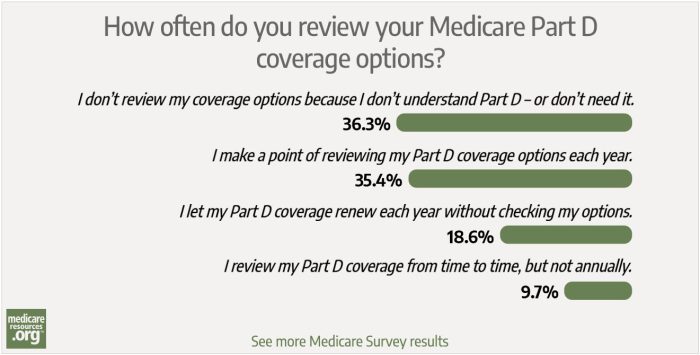

It’s important to repeat the plan comparison process each year during open enrollment, even if your medications haven’t changed – because the formularies, pharmacy networks, and out-of-pocket costs for the available PDPs may have changed, along with their premiums.

Even if you don’t take any medications, you still will want to understand which pharmacies are in-network with the Part D plans you’re considering. That way if you do need a prescription in the coming year, you will know which pharmacy options are available to you.

Other points to keep in mind:

Medicare Advantage plans have maximum out-of-pocket limits that can’t exceed $9,350 in 2025 for in-network services.

The cost of drugs covered under Part D do not apply toward that limit, since it only applies to services that are covered under Medicare Parts A and B. But starting in 2025, there’s a separate $2,000 maximum out-of-pocket limit for Part D, and that applies regardless of whether the plan is a PDP or MAPD.

Prescription drug assistance for enrollees with low incomes

Be sure to check your eligibility for Extra Help. Each year, thousands of eligible seniors do not apply and do not get the help with premiums, deductibles and copays they are eligible for. And as of 2024, the Inflation Reduction Act increased the income and asset limits for full Extra Help, expanding this valuable benefit to more people.

Read more here about assistance programs for people who have Medicare.

Louise Norris is an individual health insurance broker who has been writing about health insurance and health reform since 2006. In addition to her coverage of the individual/family market, she has written dozens of opinions and educational pieces about Medicare coverage for medicareresources.org.

Footnotes

Tags: Medicare Part D, prescription drug coverage