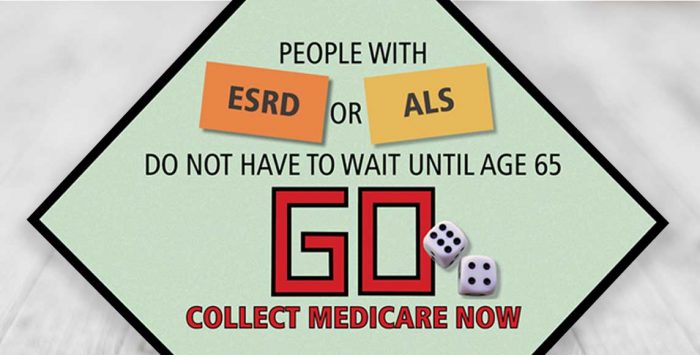

Eligibility for Medicare includes persons over age 65, those with disabilities, and those with two specific diseases: End-Stage Renal Disease (ESRD) or Amyotrophic Lateral Sclerosis (ALS, also known as Lou Gehrig’s disease).

Individuals under age 65 with disabilities other than ALS or ESRD must have received Social Security Disability benefits for 24 months before gaining eligibility for Medicare. A five-month waiting period is required after a beneficiary is determined to be disabled before a beneficiary begins to collect Social Security Disability benefits, although this no longer applies for ALS.

People with ESRD and ALS, in contrast to persons with other causes of disability, do not have to collect benefits for 24 months in order to be eligible for Medicare. The same Medicare benefits apply for individuals with ESRD and ALS as they do for all other beneficiaries.

With these benefits, if you have been diagnosed with ALS or ESRD you gain the safety and benefit of essential health care coverage through Medicare, assuming you or your spouse have a work history that makes you eligible for Medicare (or, if the patient is a child, Medicare eligibility is based on a parent’s work history). The requirements for Medicare eligibility for people with ESRD and ALS are:

- ESRD – Generally 3 months after a course of regular dialysis begins (ie, on the first day of the fourth months of dialysis), but coverage can be available as early as the first month of dialysis for people who opt for at-home dialysis.

- ALS – Immediately upon collecting Social Security Disability benefits. There used to be a five-month waiting period before SSDI benefits could begin, but legislation enacted in late 2020 eliminated that waiting period. The Social Security Administration’s eligibility page now confirms that there is no SSDI waiting period for people diagnosed with ALS.

Qualifying for Medicare with End-Stage Renal Disease

Special consideration has been given to patients diagnosed with end-stage renal disease. You will become eligible for Medicare on the first day of your fourth month of dialysis treatment. However, if you begin a self-dialysis training program you can become Medicare-eligible immediately. Importantly, if you decide to stop the self-dialysis program and start going to a dialysis center instead, your benefits will stop, and you will have to wait until you complete the four months of dialysis treatment to receive benefits again.

Patients receiving a kidney transplant may also be qualified for Medicare coverage as soon as they become hospitalized for the transplant.

For most enrollees, Medicare Part A has no premium, but Medicare Part B does have a premium ($148.50/month for most enrollees in 2021). Enrollees can select only Medicare Part A if they wish, but it’s important to understand that outpatient dialysis is covered under Part B. So it’s generally essential for people with ESRD to enroll in both parts of Medicare.

In 1972 the United States Congress passed legislation authorizing eligibility for persons diagnosed with ESRD under Medicare. The extension of coverage provided Medicare for patients with stage five chronic kidney disease (CKD), as long as they qualified under Medicare’s work history requirements. The ESRD Medicare program took effect on July 1, 1973, and was the first time that Medicare had extended benefits to people under age 65.

For ESRD patients who have an employer-sponsored health insurance policy in place in addition to Medicare, the private insurance will be the primary payer for the first 30 months, after which Medicare will become primary.

If you qualify for Medicare strictly because of ESRD (ie, you’re not yet 65 or otherwise disabled), you’re eligible for Medicare for 12 months following the last month of dialysis treatment you receive (if you no longer need dialysis but did not have a kidney transplant), or 36 months after a kidney transplant.

But starting in 2023, your immunosuppressants will continue to be covered by Medicare for the life of the transplanted organ. For enrollees whose income doesn’t exceed $97,000 (for a single person) in 2023, the price for Part B coverage that only pays for immunosuppressive drugs will be $97.10/month (as opposed to $164.90/month that other beneficiaries pay for full Part B coverage).

Legislation was introduced in 2019 to extend Medicare coverage for immunosuppressant drugs following a kidney transplant. That legislation ended up being incorporated into the third COVID relief package, signed into law in December 2020. This provision has been heralded by patient advocates who note that many people end up rationing or ceasing their immunosuppressants once the 36 months of Medicare coverage ends. This almost always leads to rejection of the transplanted kidney, and sends the patient back to dialysis and the transplant waiting list (and Medicare coverage). Not only does this lead to a reduced quality of life for the patient, but it’s also much more costly for Medicare to pay for dialysis than it is to pay for immunosuppressants.

Prior to 2021, most Medicare Advantage plans did not accept new enrollees who had ESRD (the exceptions Medicare Advantage ESRD Special Needs Plans, although these were not widely available). But this changed as of 2021 under the terms of the 21st Century Cures Act; Medicare Advantage plans are now guaranteed issue for all Medicare beneficiaries, including those with ESRD.

People who enroll in Original Medicare have the option to purchase a Medicare Part D plan to cover prescription drugs. These plans are guaranteed-issue when you first enroll in Medicare, and there’s an annual election period (October 15 to December 7) during which you can switch to a different Part D plan, regardless of your medical history. But the other form of supplemental coverage, Medigap, isn’t always available to people who are under 65 and enrolling Medicare as a result of a disability, including ESRD.

There are 33 states that require Medigap plans to be guaranteed-issue for patients when they first become eligible for Medicare prior to the age of 65. But some of those states specifically clarify that plans do not have to be offered to patients with ESRD, or can be offered to them with higher premiums.

In most of the states that do require Medigap insurers to make plans available to ESRD patients under age 65, the premiums are typically higher than they would be if the applicant was enrolling in Medicare due to turning 65. In the states that don’t have specific regulations for Medigap insurers, an insurer can reject an application from an under-65 enrollee who has become eligible for Medicare as a result of ESRD. This can result in significant out-of-pocket expenses for ESRD patients, who have to pay 20% of the Medicare-approved charge for each dialysis session if they don’t have supplemental coverage that picks up the extra cost (there’s no cap on out-of-pocket costs for Original Medicare).

The new provision allowing ESRD patients to enroll in Medicare Advantage plans can be helpful in these situations, as long as the person’s hospital, doctors, and dialysis clinic are all covered under the plan’s network.

Medicare has a 60-page booklet all about Medicare coverage of dialysis and kidney transplants.

Medicare and ALS (Lou Gehrig’s Disease) coverage

As with ESDR, if your disability is amyotrophic lateral sclerosis (ALS, or Lou Gehrig’s disease), you don’t have to wait 24 months for Medicare coverage. You can get Medicare as soon as you become entitled to SSDI. And although there used to be a five-month waiting period after applying for disability benefits before they are awarded, that’s no longer the case. Legislation was enacted in late 2020 that ended the waiting period, allowing ALS patients to get SSDI and Medicare immediately after diagnosis.

In 2001, Congress passed landmark legislation to add ALS as a qualifying condition for automatic Medicare coverage. The regular 24-month waiting period (after SSDI benefits begin) was eliminated for ALS patients receiving SSDI. And now the 5-month waiting period to begin SSDI benefits has also been eliminated.

Enrollees with ALS can select a Medicare Part D plan when they become eligible for Medicare, which will help with the cost of prescription drugs. But as is the case with ESRD, people who are under 65 and enrolled in Medicare due to ALS might not have access to a Medigap plan, depending on where they live. There are 33 states that have at least some sort of guaranteed issue requirements for Medigap when a disabled Medicare beneficiary is under age 65, although insurers may still be able to charge higher premiums for enrollees under the age of 65 (in most of the remaining states, there is either a high-risk pool option for Medicare beneficiaries under age 65, or at least some insurers voluntarily offer Medigap plans to people under 65).

If you have ALS and you’re enrolled in Medicare Parts A and B, you can choose to enroll in a Medicare Advantage plan that’s available in your area. Choosing between Original Medicare (plus Medigap, if the plans are available to you) and Medicare Advantage is a personal decision — here are some questions to help you figure out which option might be a better fit. But if you’re in a state where Medigap is not available to you as an under-65 enrollee, the out-of-pocket limits on Medicare Advantage plans might be appealing, as Original Medicare (without a Medigap plan) does not limit out-of-pocket costs.

In 2014, The ALS community reacted strongly to a CMS announcement that some medical devices used by ALS patients would no longer be covered by Medicare. Medicare does cover basic speech generation devices, but since 2001, patients have been able to pay the additional cost to get “upgradable devices” that can be used to perform additional tasks like opening doors, switching on lights, and connecting to the internet. As technology has advanced, so has the use of these devices.

In good news for ALS patients, CMS announced in November 2014 that they had decided to hold off on enforcing the rule regarding upgradable devices, so ALS patients could still get Medicare funding for the basic cost of such devices, as long as they paid for any upgrades themselves. There was an ongoing concern, however, that CMS could implement the new rules at a later date.

But the Steve Gleason Act of 2015 provided Medicare funding for communication devices through 2018. And in 2018, the Steve Gleason Act was approved as part of a budget bill, providing permanent Medicare funding of communication devices — including eye-tracking technology and speech generating devices — and the required accessories.

Application for Social Security Disability Insurance

SSA has an expedited procedure for processing terminal illness cases to ensure that a favorable decision can be made expeditiously. The term for this type of case is “TERI” case. A person with ALS, particularly if advanced symptoms are present, will want to advise SSA, at the time of application, that TERI case procedures are appropriate.

Louise Norris is an individual health insurance broker who has been writing about health insurance and health reform since 2006. She has written dozens of opinions and educational pieces about the Affordable Care Act for healthinsurance.org. Her state health exchange updates are regularly cited by media who cover health reform and by other health insurance experts.